| Zacks Company Profile for Snap Inc. (SNAP : NYSE) |

|

|

| |

| • Company Description |

| Snap's flagship product, Snapchat, is a mobile camera application that helps people to communicate through short videos and images called Snaps. The application is one of the most popular and trendy messaging and social media applications in the United States. It is also growing rapidly in other international markets, such as India.Snapchat's popularity, especially with teens and millennials, can primarily be attributed to its ephemerality i.e. photos/videos and text sent to friends via Snapchat disappear after sometime. Moreover, an interactive style of chat developed by the addition of stickers, doodling etc. has really caught the fancy of teens. Advertising forms the mainstay of Snap's revenues. The company is helping advertisers reach millennials and Gen Z audience, who are more active on immersive mobile platforms like Snapchat.

Number of Employees: 5,261 |

|

|

| |

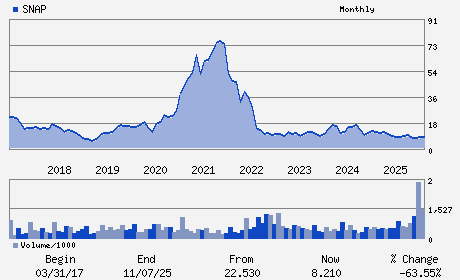

| • Price / Volume Information |

| Yesterday's Closing Price: $5.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 62,266,764 shares |

| Shares Outstanding: 1,688.95 (millions) |

| Market Capitalization: $8,799.44 (millions) |

| Beta: 0.83 |

| 52 Week High: $10.41 |

| 52 Week Low: $4.65 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-24.82% |

-24.16% |

| 12 Week |

-34.13% |

-34.22% |

| Year To Date |

-35.44% |

-35.75% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3000 31ST STREET

-

SANTA MONICA,CA 90405

USA |

ph: 310-399-3339

fax: - |

ir@snapchat.com |

http://www.snap.com |

|

|

| |

| • General Corporate Information |

Officers

Evan Spiegel - Chief Executive Officer and Director

Derek Andersen - Chief Financial Officer

Rebecca Morrow - Chief Accounting Officer

Robert Murphy - Chief Technology Officer

Kelly Coffey - Director

|

|

Peer Information

Snap Inc. (ADP)

Snap Inc. (CWLD)

Snap Inc. (CYBA.)

Snap Inc. (ZVLO)

Snap Inc. (AZPN)

Snap Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 83304A106

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 1,688.95

Most Recent Split Date: (:1)

Beta: 0.83

Market Capitalization: $8,799.44 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.08 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.15 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 34.50% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |