| Zacks Company Profile for Schneider National, Inc. (SNDR : NYSE) |

|

|

| |

| • Company Description |

| Schneider National is a leading transportation and logistics services company. The company offers a portfolio of premier truckload, intermodal and logistics solutions. Additionally, Schneider National operates one of the largest for-hire trucking fleets in North America. The company's offerings include dry van, bulk transport, intermodal and supply chain management. The company operates through the truckload, intermodal and logistics segments.

Number of Employees: 19,000 |

|

|

| |

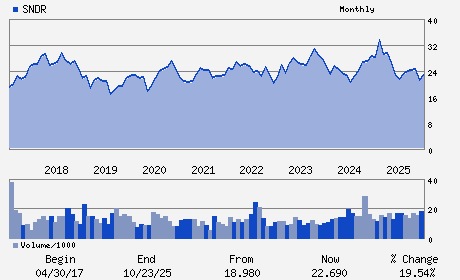

| • Price / Volume Information |

| Yesterday's Closing Price: $28.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 951,904 shares |

| Shares Outstanding: 175.34 (millions) |

| Market Capitalization: $4,976.05 (millions) |

| Beta: 1.06 |

| 52 Week High: $30.98 |

| 52 Week Low: $20.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.74% |

6.66% |

| 12 Week |

9.36% |

9.23% |

| Year To Date |

6.97% |

6.45% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mark B. Rourke - President; Chief Executive Officer

James L. Welch - Chairman of the Board

Darrell G. Campbell - Executive Vice President; Chief Financial Officer

Shelly A. Dumas-Magnin - Vice President and Controller

Thomas G. Jackson - Executive Vice President; General Counsel & Corpor

|

|

Peer Information

Schneider National, Inc. (HKAEY)

Schneider National, Inc. (UHAL)

Schneider National, Inc. (LYNG)

Schneider National, Inc. (MATX)

Schneider National, Inc. (GLC)

Schneider National, Inc. (FAVS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SERVICES

Sector: Transportation

CUSIP: 80689H102

SIC: 4213

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 175.34

Most Recent Split Date: (:1)

Beta: 1.06

Market Capitalization: $4,976.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.34% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.11 |

Indicated Annual Dividend: $0.38 |

| Current Fiscal Year EPS Consensus Estimate: $0.84 |

Payout Ratio: 0.61 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.31 |

| Estmated Long-Term EPS Growth Rate: 36.37% |

Last Dividend Paid: 12/12/2025 - $0.09 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |