| Zacks Company Profile for Senestech, Inc. (SNES : NSDQ) |

|

|

| |

| • Company Description |

| SenesTech, Inc. developed technology for managing animal pest populations through fertility control as opposed to a lethal approach. The Company's fertility control product candidate, ContraPest(R), will be marketed for use initially in controlling rat infestations. SenesTech, Inc. is based in Flagstaff, Arizona.

Number of Employees: 23 |

|

|

| |

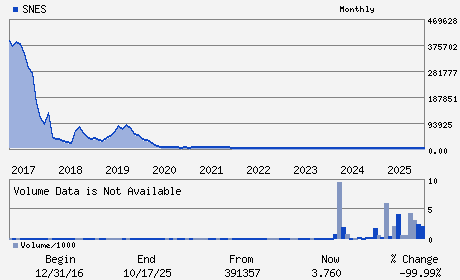

| • Price / Volume Information |

| Yesterday's Closing Price: $2.25 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 70,243 shares |

| Shares Outstanding: 5.22 (millions) |

| Market Capitalization: $11.75 (millions) |

| Beta: 0.14 |

| 52 Week High: $6.24 |

| 52 Week Low: $1.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

21.62% |

22.68% |

| 12 Week |

-24.24% |

-24.34% |

| Year To Date |

5.14% |

4.63% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Joel Fruendt - President and Chief Executive Officer

Jamie Bechtel - Chair of the Board

Thomas C. Chesterman - Executive Vice President; Chief Financial Officer;

Phil Grandinetti - Director

Jake Leach - Director

|

|

Peer Information

Senestech, Inc. (CSBHY)

Senestech, Inc. (ARWM)

Senestech, Inc. (FUL)

Senestech, Inc. (IAX)

Senestech, Inc. (AVD)

Senestech, Inc. (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 81720R604

SIC: 2870

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/11/26

|

|

Share - Related Items

Shares Outstanding: 5.22

Most Recent Split Date: 7.00 (0.10:1)

Beta: 0.14

Market Capitalization: $11.75 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.11 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/11/26 |

|

|

|

| |