| Zacks Company Profile for Smith & Nephew SNATS, Inc. (SNN : NYSE) |

|

|

| |

| • Company Description |

| Smith & Nephew is a global medical device company. The company markets clinically superior products, principally in orthopaedics, endoscopy and wound management to deliver cost-effective solutions, significant physicianadvantage and real patient benefits. A continuous process of supplying new and innovative products is supported by substantial R&D investment todeliver new levels of healing to patients throughout the world

Number of Employees: 17,349 |

|

|

| |

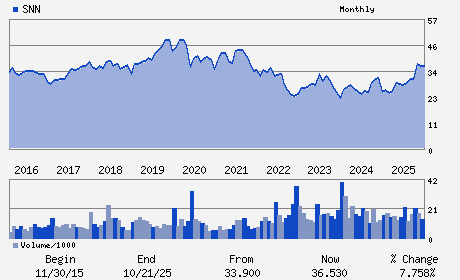

| • Price / Volume Information |

| Yesterday's Closing Price: $36.90 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 770,406 shares |

| Shares Outstanding: 424.91 (millions) |

| Market Capitalization: $15,679.03 (millions) |

| Beta: 0.62 |

| 52 Week High: $38.79 |

| 52 Week Low: $23.91 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.08% |

9.03% |

| 12 Week |

10.22% |

10.08% |

| Year To Date |

12.47% |

11.92% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Deepak Nath - Chief Executive Officer

Rupert Soames - Chairman

John Rogers - Chief Financial Officer

Bob White - Independent Non-Executive Director

Rick Medlock - Independent Non-Executive Director

|

|

Peer Information

Smith & Nephew SNATS, Inc. (BJCT)

Smith & Nephew SNATS, Inc. (CADMQ)

Smith & Nephew SNATS, Inc. (APNO)

Smith & Nephew SNATS, Inc. (UPDC)

Smith & Nephew SNATS, Inc. (IMTIQ)

Smith & Nephew SNATS, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 83175M205

SIC: 3842

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 03/03/26

|

|

Share - Related Items

Shares Outstanding: 424.91

Most Recent Split Date: 10.00 (2.50:1)

Beta: 0.62

Market Capitalization: $15,679.03 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.54% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.57 |

| Current Fiscal Year EPS Consensus Estimate: $2.33 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 18.14% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/03/26 |

|

|

|

| |