| Zacks Company Profile for Sanofi (SNY : NSDQ) |

|

|

| |

| • Company Description |

| Sanofi-Aventis manufactures & markets prescription drugs across countries. It focuses on major therapeutic areas such as multiple sclerosis, cardiovascular, immunology, neurology, oncology, rare blood disorders & diabetes, etc. By taking Genzyme Corporation as a subsidiary, it added products like Cerezyme, Myozyme/Lumizyme & Fabrazyme to its portfolio. Sanofi has become a major player in the CHC sector. It acquired many companies i.e. Ablynx & Bioverativ, Synthorx & Principia & Translate Bio and Kadmon. It has collaborated with companies like Regeneron among others. It develops and markets Dupixent, Kevzara & Libtayo in collaboration with Regeneron. Sanofi, along with Regeneron, is now solely responsible for Praluent marketing in & outside the U.S. Sanofi operates through 3 Global Business Units: Specialty Care (neurology & immunology, rare diseases, rare blood disorders & oncology), Vaccines & General Medicines (diabetes, cardiovascular & established products) and Consumer Healthcare, a standalone unit.

Number of Employees: 74,846 |

|

|

| |

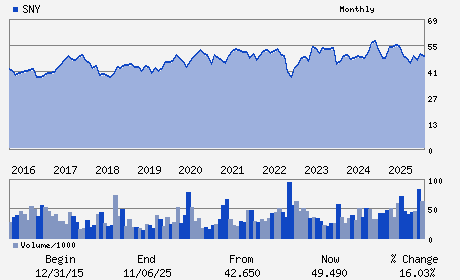

| • Price / Volume Information |

| Yesterday's Closing Price: $47.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,015,045 shares |

| Shares Outstanding: 2,439.00 (millions) |

| Market Capitalization: $116,242.95 (millions) |

| Beta: 0.45 |

| 52 Week High: $60.12 |

| 52 Week Low: $44.62 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.83% |

2.21% |

| 12 Week |

-1.61% |

-2.11% |

| Year To Date |

-1.65% |

-2.17% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

46 AVENUE DE LA GRANDE ARMEE

-

PARIS,I0 75017

FRA |

ph: 33-1-53-77-44-00

fax: 33-1-53-77-43-03 |

ir@sanofi.com |

http://www.sanofi.com |

|

|

| |

| • General Corporate Information |

Officers

Paul Hudson - Chief Executive Officer

Frederic Oudea - Chairman of the Board

Olivier Charmeil - Executive Vice President; Chief Financial Officer

Brian Foard - Director

Emmanuel Frenehard - Director

|

|

Peer Information

Sanofi (AGN.)

Sanofi (NVS)

Sanofi (NVO)

Sanofi (LLY)

Sanofi (RHHBY)

Sanofi (JNJ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Large Cap Pharma

Sector: Medical

CUSIP: 80105N105

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 2,439.00

Most Recent Split Date: (:1)

Beta: 0.45

Market Capitalization: $116,242.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.35% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.06 |

Indicated Annual Dividend: $1.60 |

| Current Fiscal Year EPS Consensus Estimate: $4.97 |

Payout Ratio: 0.36 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 7.78% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |