| Zacks Company Profile for SuperCom, Ltd. (SPCB : NSDQ) |

|

|

| |

| • Company Description |

| SuperCom Ltd. is a provider of radio frequency identification solutions. It offers advanced safety, identification and security products and solutions primarily to Governments, private and public organizations. The Company produces systems for viewing, tracking, locating, credentialing, and managing assets and personnel. SuperCom Ltd., formerly known as Vuance Ltd., is headquartered in Qadima, Israel.

Number of Employees: 124 |

|

|

| |

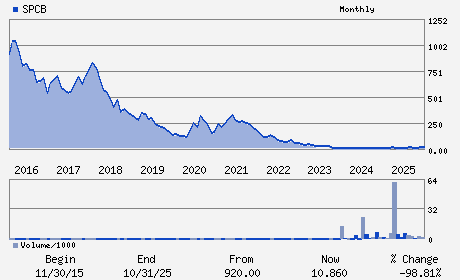

| • Price / Volume Information |

| Yesterday's Closing Price: $8.47 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 50,482 shares |

| Shares Outstanding: 2.93 (millions) |

| Market Capitalization: $24.82 (millions) |

| Beta: 0.95 |

| 52 Week High: $13.57 |

| 52 Week Low: $5.06 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.84% |

-10.06% |

| 12 Week |

-10.94% |

-11.05% |

| Year To Date |

-6.41% |

-6.86% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3 ROTHCHILD STREET

-

TEL AVIV,L3 6688106

ISR |

ph: 972-9889-0850

fax: 972-9889-0820 |

ir@supercom.com |

http://www.supercom.com |

|

|

| |

| • General Corporate Information |

Officers

Ordan Trabelsi - President and Chief Executive Officer

Barak Trabelsi - Chief Operating Officer

Arie Trabelsi - Chief Financial Officer

Gil Alfi - Vice President Sales

Lester Villeneuve - Director

|

|

Peer Information

SuperCom, Ltd. (BRC)

SuperCom, Ltd. (ALGI)

SuperCom, Ltd. (SYNX.)

SuperCom, Ltd. (ADSV)

SuperCom, Ltd. (CDCY)

SuperCom, Ltd. (CSCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: PROTECTION-SFTY

Sector: Industrial Products

CUSIP: M87095309

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 2.93

Most Recent Split Date: 8.00 (0.05:1)

Beta: 0.95

Market Capitalization: $24.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |