| Zacks Company Profile for Stoneridge, Inc. (SRI : NYSE) |

|

|

| |

| • Company Description |

| Stoneridge Inc. is an independent designer and manufacturer of highly engineered electrical and electronic components, modules and systems forthe automotive, medium and heavy-duty truck, and agricultural vehicle markets. Their products interface with a vehicle's mechanical and electrical systems to activate equipment and accessories, display and monitor vehicle performance, and control and distribute electrical power and signals.

Number of Employees: 4,450 |

|

|

| |

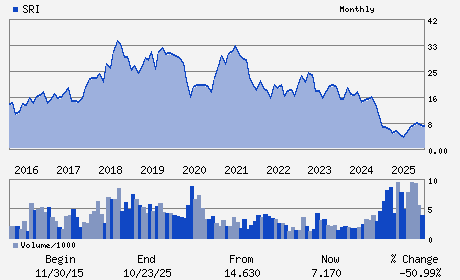

| • Price / Volume Information |

| Yesterday's Closing Price: $7.89 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 205,928 shares |

| Shares Outstanding: 28.02 (millions) |

| Market Capitalization: $221.05 (millions) |

| Beta: 1.45 |

| 52 Week High: $9.71 |

| 52 Week Low: $3.54 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

19.91% |

20.96% |

| 12 Week |

34.41% |

34.25% |

| Year To Date |

36.27% |

35.61% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

James Zizelman - President; Chief Executive Officer and Director

William M. Lasky - Chairman

Matthew R. Horvath - Chief Financial Officer and Treasurer

Robert J. Hartman - Chief Accounting Officer

George S. Mayes - Director

|

|

Peer Information

Stoneridge, Inc. (SMTI.)

Stoneridge, Inc. (DDICQ)

Stoneridge, Inc. (CGGIQ)

Stoneridge, Inc. (CRDN)

Stoneridge, Inc. (CDTS)

Stoneridge, Inc. (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: 86183P102

SIC: 3714

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 28.02

Most Recent Split Date: (:1)

Beta: 1.45

Market Capitalization: $221.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |