| Zacks Company Profile for Sarepta Therapeutics, Inc. (SRPT : NSDQ) |

|

|

| |

| • Company Description |

| Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company that focuses on the discovery and development of RNA-based therapeutics targeting rare and infectious diseases. It concentrates on the development of exon-skipping drug candidates targeting Duchenne muscular dystrophy (DMD), a rare genetic disorder affecting children. The company received accelerated approval for Exondys 51, Amondys 45 (casimersen) and Vyondys 53 (golodirsen). Exondys 51 is Sarepta's first PMO-based technology to be granted accelerated approval by the FDA. The company is conducting a confirmatory study on the clinical benefits of these drugs for gaining continued approval. The rest of its exon-skipping DMD pipeline includes a PPMO-based, exon 51 skipping candidate, SRP-5051. Sarepta is also developing gene therapies for treating DMD, Limb-girdle muscular dystrophy and central nervous system disorders including Mucopolysaccharidosis type IIIA and Pompe Disease.

Number of Employees: 1,372 |

|

|

| |

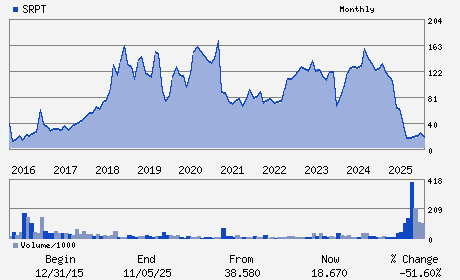

| • Price / Volume Information |

| Yesterday's Closing Price: $16.32 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,289,147 shares |

| Shares Outstanding: 104.79 (millions) |

| Market Capitalization: $1,710.13 (millions) |

| Beta: 0.42 |

| 52 Week High: $107.77 |

| 52 Week Low: $10.42 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-21.24% |

-20.15% |

| 12 Week |

-25.34% |

-25.72% |

| Year To Date |

-24.16% |

-24.56% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Douglas S. Ingram - President; Chief Executive Officer

M. Kathleen Behrens - Chairwoman of the Board

Ian M. Estepan - Executive Vice President; Chief Financial Officer

Richard Barry - Director

Deirdre Connelly - Director

|

|

Peer Information

Sarepta Therapeutics, Inc. (CORR.)

Sarepta Therapeutics, Inc. (RSPI)

Sarepta Therapeutics, Inc. (CGXP)

Sarepta Therapeutics, Inc. (BGEN)

Sarepta Therapeutics, Inc. (GTBP)

Sarepta Therapeutics, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 803607100

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 104.79

Most Recent Split Date: 7.00 (0.17:1)

Beta: 0.42

Market Capitalization: $1,710.13 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.23 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.71 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 22.90% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |