| Zacks Company Profile for Sysmex Corporation ADR (SSMXY : OTC) |

|

|

| |

| • Company Description |

| Sysmex Corporation is engaged in the development, manufacture, import, export and sale of clinical laboratory instruments, reagents and software used in -vitro diagnostics. It also provides clinical laboratory testing of blood, urine and other specimens. The company's product includes instruments and reagents diagnostics for hemostasis, immunochemistry, clinical chemistry, urinalysis and point-of-care testing. Its operating segment consists of Japan, Americas, EMEA, China and Asia Pacific. Sysmex Corporation is headquartered in Kobe, Japan.

Number of Employees: 11,457 |

|

|

| |

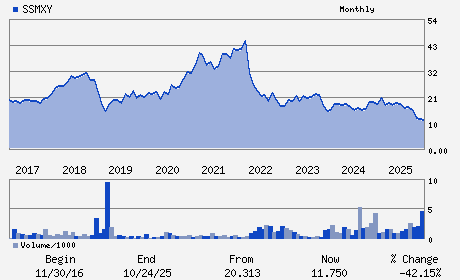

| • Price / Volume Information |

| Yesterday's Closing Price: $9.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 254,515 shares |

| Shares Outstanding: 629.48 (millions) |

| Market Capitalization: $5,904.52 (millions) |

| Beta: 1.14 |

| 52 Week High: $19.68 |

| 52 Week Low: $8.15 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.74% |

0.13% |

| 12 Week |

1.63% |

1.50% |

| Year To Date |

-3.79% |

-4.26% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1-5-1 Wakihama Kaigan-dori Chuo-ku

-

Kobe,M0 651-0073

JPN |

ph: 817-8265-0500

fax: 817-8265-0524 |

None |

http://www.sysmex.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Tsune Ietsugu - Group Chief Executive Officer;Chairman and Directo

Kaoru Asano - President;Chief Executive Officer and Director

Tomokazu Yoshida - Chief Technology Officer and Director

Kazuo Ota - Director

Haruo Inoue - Director

|

|

Peer Information

Sysmex Corporation ADR (ABMD)

Sysmex Corporation ADR (DMDS)

Sysmex Corporation ADR (CPWY.)

Sysmex Corporation ADR (EQUR)

Sysmex Corporation ADR (ECIA)

Sysmex Corporation ADR (FMS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED INSTRUMENTS

Sector: Medical

CUSIP: 87184P109

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/13/26

|

|

Share - Related Items

Shares Outstanding: 629.48

Most Recent Split Date: 4.00 (1.50:1)

Beta: 1.14

Market Capitalization: $5,904.52 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.54% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.14 |

| Current Fiscal Year EPS Consensus Estimate: $0.54 |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/13/26 |

|

|

|

| |