| Zacks Company Profile for Shutterstock, Inc. (SSTK : NYSE) |

|

|

| |

| • Company Description |

| Shutterstock, Inc. is a global marketplace for digital imagery. It provides licensed photographs, vectors, illustrations and videos to businesses, marketing agencies and media organizations around the world. The Company's online marketplace provides a freely searchable library of commercial digital images that the users can pay to license, download and incorporate into their work. Shutterstock, Inc. is headquartered in New York.

Number of Employees: 1,565 |

|

|

| |

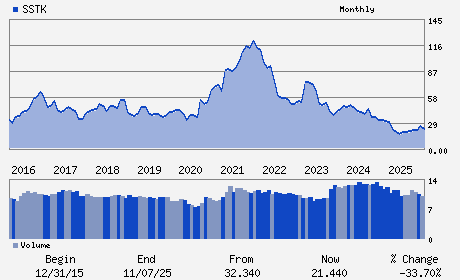

| • Price / Volume Information |

| Yesterday's Closing Price: $16.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 454,849 shares |

| Shares Outstanding: 35.55 (millions) |

| Market Capitalization: $597.18 (millions) |

| Beta: 1.23 |

| 52 Week High: $29.50 |

| 52 Week Low: $14.35 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-15.36% |

-14.62% |

| 12 Week |

-11.62% |

-11.73% |

| Year To Date |

-12.04% |

-12.47% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Paul J. Hennessy - Chief Executive Officer and Director

Jonathan Oringer - Founder and Executive Chairman of the Board

Rik Powell - Chief Financial Officer

Steven Ciardiello - Chief Accounting Officer

Rachna Bhasin - Director

|

|

Peer Information

Shutterstock, Inc. (HHNT)

Shutterstock, Inc. (CDCAQ)

Shutterstock, Inc. (IPIXQ)

Shutterstock, Inc. (CNET.)

Shutterstock, Inc. (DTHK)

Shutterstock, Inc. (ADAM.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET CONTENT

Sector: Computer and Technology

CUSIP: 825690100

SIC: 7374

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/01/26

|

|

Share - Related Items

Shares Outstanding: 35.55

Most Recent Split Date: (:1)

Beta: 1.23

Market Capitalization: $597.18 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.86% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.80 |

Indicated Annual Dividend: $1.32 |

| Current Fiscal Year EPS Consensus Estimate: $2.73 |

Payout Ratio: 0.51 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.14 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/04/2025 - $0.33 |

| Next EPS Report Date: 05/01/26 |

|

|

|

| |