| Zacks Company Profile for Stellar Bancorp, Inc. (STEL : NYSE) |

|

|

| |

| • Company Description |

| Stellar Bancorp Inc. is a bank holding company. Its principal banking subsidiary, created by the merger of Allegiance Bank and Community Bank of Texas. The company provides a diversified range of commercial banking services primarily to small- to medium-sized businesses and individual customers. Stellar Bancorp Inc., formerly known as CBTX Inc., is based in HOUSTON.

Number of Employees: 1,053 |

|

|

| |

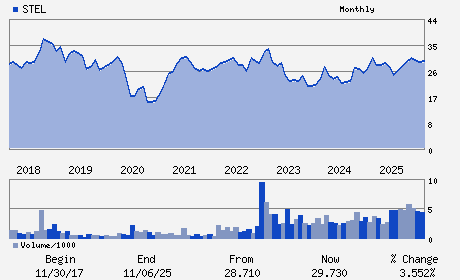

| • Price / Volume Information |

| Yesterday's Closing Price: $37.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 844,790 shares |

| Shares Outstanding: 50.77 (millions) |

| Market Capitalization: $1,912.08 (millions) |

| Beta: 0.77 |

| 52 Week High: $40.21 |

| 52 Week Low: $24.13 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.40% |

2.29% |

| 12 Week |

18.95% |

18.81% |

| Year To Date |

21.72% |

21.13% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

9 GREENWAY PLAZA SUITE 110

-

HOUSTON,TX 77046

USA |

ph: 713-210-7600

fax: - |

ir@stellar.bank |

http://www.stellar.bank |

|

|

| |

| • General Corporate Information |

Officers

Robert R. Franklin, Jr. - Chief Executive Officer and Director

Paul P. Egge - Chief Financial Officer

Laura Bellows - Director

John Beckworth - Director

Cynthia Dopjera - Director

|

|

Peer Information

Stellar Bancorp, Inc. (TSFG)

Stellar Bancorp, Inc. (ABCB)

Stellar Bancorp, Inc. (CFNL)

Stellar Bancorp, Inc. (CPKF)

Stellar Bancorp, Inc. (HIB)

Stellar Bancorp, Inc. (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 858927106

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 50.77

Most Recent Split Date: (:1)

Beta: 0.77

Market Capitalization: $1,912.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.59% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.47 |

Indicated Annual Dividend: $0.60 |

| Current Fiscal Year EPS Consensus Estimate: $2.03 |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.15 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |