| Zacks Company Profile for Stem, Inc. (STEM : NYSE) |

|

|

| |

| • Company Description |

| Stem Inc. is an artificial intelligence -driven clean energy storage systems. The company's advanced energy storage solutions with Athena(TM), an artificial intelligence -powered analytics platform, enables customers and partners to optimize energy use by automatically switching between battery power, onsite generation and grid power. Stem Inc., formerly known as Star Peak Energy Transition Corp., is based in MILLBRAE, Calif.

Number of Employees: 569 |

|

|

| |

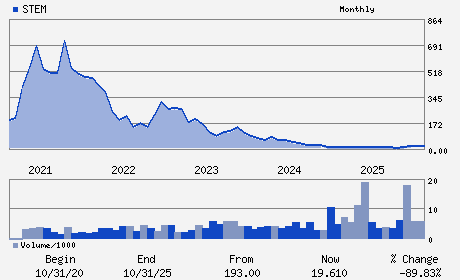

| • Price / Volume Information |

| Yesterday's Closing Price: $10.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 175,167 shares |

| Shares Outstanding: 8.39 (millions) |

| Market Capitalization: $88.18 (millions) |

| Beta: 1.31 |

| 52 Week High: $32.23 |

| 52 Week Low: $5.81 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-32.63% |

-32.04% |

| 12 Week |

-42.57% |

-42.64% |

| Year To Date |

-30.17% |

-30.50% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1400 Post Oak Boulevard. Suite 560

-

Houston,TX 77056

USA |

ph: 1-877-374-7836

fax: - |

ir@stem.com |

http://www.stem.com |

|

|

| |

| • General Corporate Information |

Officers

Arun Narayanan - Chief Executive Officer

David Buzby - Chairman

Spencer Doran Hole - Chief Financial Officer

Rahul Shukla - Chief Accounting Officer

Adam E. Daley - Director

|

|

Peer Information

Stem, Inc. (UIS)

Stem, Inc. (CTSH)

Stem, Inc. (ASGN)

Stem, Inc. (GTTNQ)

Stem, Inc. (DXC)

Stem, Inc. (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 85859N300

SIC: 3690

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 8.39

Most Recent Split Date: 6.00 (0.05:1)

Beta: 1.31

Market Capitalization: $88.18 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-2.21 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-7.51 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |