| Zacks Company Profile for Sun Communities, Inc. (SUI : NYSE) |

|

|

| |

| • Company Description |

| Sun Communities, Inc. owns, operates & finances manufactured housing communities concentrated in the midwestern & southeastern US. The Company is a fully integrated real estate company which, together with its affiliates and predecessors, has been in the business of acquiring, operating & expanding manufactured housing communities since 1975. The Company owns & manages a portfolio of properties located in twelve states, including manufactured housing communities, recreational vehicle communities, & properties containing both manufactured housing & recreational vehicle sites.

Number of Employees: 3,614 |

|

|

| |

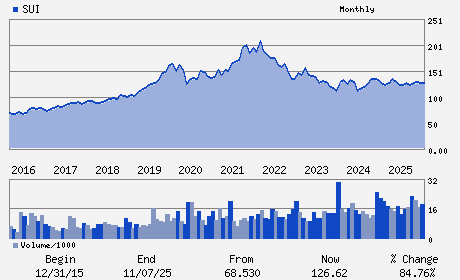

| • Price / Volume Information |

| Yesterday's Closing Price: $136.46 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 974,001 shares |

| Shares Outstanding: 123.18 (millions) |

| Market Capitalization: $16,809.78 (millions) |

| Beta: 0.87 |

| 52 Week High: $137.84 |

| 52 Week Low: $109.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.09% |

8.02% |

| 12 Week |

6.42% |

6.29% |

| Year To Date |

10.13% |

9.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Charles D. Young - Chief Executive Officer and Director

Gary A. Shiffman - Chairman

Fernando Castro-Caratini - Executive Vice President; Chief Financial Officer;

Brian Loftus - Senior Vice President and Chief Accounting Officer

Tonya Allen - Director

|

|

Peer Information

Sun Communities, Inc. (CPT)

Sun Communities, Inc. (BHM)

Sun Communities, Inc. (EQR)

Sun Communities, Inc. (SAFE)

Sun Communities, Inc. (AEC)

Sun Communities, Inc. (VRE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST - RESID

Sector: Finance

CUSIP: 866674104

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 123.18

Most Recent Split Date: (:1)

Beta: 0.87

Market Capitalization: $16,809.78 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.05% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.28 |

Indicated Annual Dividend: $4.16 |

| Current Fiscal Year EPS Consensus Estimate: $6.96 |

Payout Ratio: 0.62 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: 4.32% |

Last Dividend Paid: 12/31/2025 - $1.04 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |