| Zacks Company Profile for Silvercorp Metals Inc. (SVM : AMEX) |

|

|

| |

| • Company Description |

| Silvercorp Metals, Inc. engages in the acquisition, exploration, development, and mining of precious and base metal mineral properties in the Peoples Republic of China. It explores for silver, gold, lead, and zinc properties. The company primarily operates and develops four Silver-Lead-Zinc mines at the Ying Mining Camp, Henan Province; and the Na-Bao Polymetalic Project in Qinghai Province, China. The company is growing its resource base through continuous exploration of existing projects as well as acquiring new development and exploration projects in multiple jurisdictions. Silvercorp is listed on the Toronto Stock Exchange and the NYSE under the symbol `T.SVM` and `SVM` respectively.

Number of Employees: 1,190 |

|

|

| |

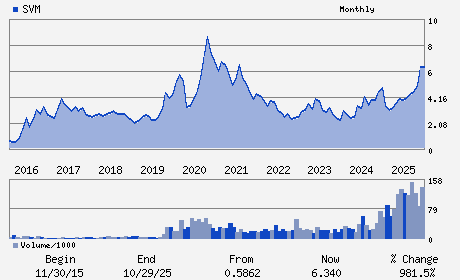

| • Price / Volume Information |

| Yesterday's Closing Price: $13.93 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,311,947 shares |

| Shares Outstanding: 220.84 (millions) |

| Market Capitalization: $3,076.35 (millions) |

| Beta: 0.92 |

| 52 Week High: $14.00 |

| 52 Week Low: $3.15 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

38.33% |

39.54% |

| 12 Week |

76.11% |

75.89% |

| Year To Date |

67.03% |

66.22% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Rui Feng - Chief Executive Officer and Chairman

Lon Shaver - President

Derek Liu - Chief Financial Officer

Jonathan Hoyles - General Counsel and Corporate Secretary

Paul Simpson - Director

|

|

Peer Information

Silvercorp Metals Inc. (DMM.)

Silvercorp Metals Inc. (HNDNF)

Silvercorp Metals Inc. (ANUC)

Silvercorp Metals Inc. (CAU)

Silvercorp Metals Inc. (ENVG.)

Silvercorp Metals Inc. (EMEX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -MISC

Sector: Basic Materials

CUSIP: 82835P103

SIC: 1040

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/28/26

|

|

Share - Related Items

Shares Outstanding: 220.84

Most Recent Split Date: (:1)

Beta: 0.92

Market Capitalization: $3,076.35 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.18% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.19 |

Indicated Annual Dividend: $0.03 |

| Current Fiscal Year EPS Consensus Estimate: $0.62 |

Payout Ratio: 0.05 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/28/26 |

|

|

|

| |