| Zacks Company Profile for Stanley Black & Decker, Inc. (SWK : NYSE) |

|

|

| |

| • Company Description |

| Stanley Black & Decker, Inc. manufactures and provides tools and related accessories, engineered fastening systems and several other items and services. Stanley Black now reports its operations under two business segments - Industrial and Tools & Storage. Industrial segment manufactures and markets engineered fastening products, as well as hydraulic tools, accessories and attachments. The segment also engages in renting and selling coating, custom pipe handling and joint welding equipment. The products are sold to industrial customers. Businesses included are Engineered Fastening and Infrastructure. Tools & Storage segment manufactures and markets power tools for professional, consumer tools, hand tools, storage systems, pneumatic tools and fasteners. These products are sold to professionals and consumers. Businesses included are Power Tools & Equipment, and Hand Tools, Accessories & Storage businesses. Products across bothe segments are sold through various distribution channels.

Number of Employees: 43,500 |

|

|

| |

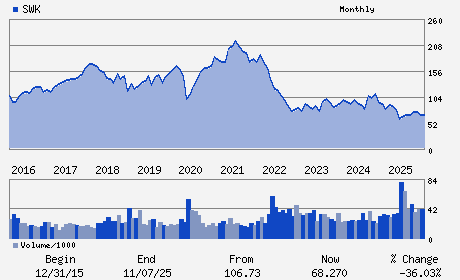

| • Price / Volume Information |

| Yesterday's Closing Price: $86.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,099,317 shares |

| Shares Outstanding: 155.08 (millions) |

| Market Capitalization: $13,412.82 (millions) |

| Beta: 1.18 |

| 52 Week High: $93.37 |

| 52 Week Low: $53.91 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.95% |

10.92% |

| 12 Week |

19.35% |

19.20% |

| Year To Date |

16.44% |

15.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christopher J. Nelson - President and Chief Executive Officer

Donald Allan - Chairman

Patrick Hallinan - Executive Vice President and Chief Financial Offic

Andrea J. Ayers - Director

Susan K. Carter - Director

|

|

Peer Information

Stanley Black & Decker, Inc. (DVLGQ)

Stanley Black & Decker, Inc. (CNM)

Stanley Black & Decker, Inc. (FLOW.)

Stanley Black & Decker, Inc. (AMDLY)

Stanley Black & Decker, Inc. (HURC)

Stanley Black & Decker, Inc. (LECO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH TLS&RL PRD

Sector: Industrial Products

CUSIP: 854502101

SIC: 3420

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 155.08

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.18

Market Capitalization: $13,412.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.84% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.61 |

Indicated Annual Dividend: $3.32 |

| Current Fiscal Year EPS Consensus Estimate: $5.22 |

Payout Ratio: 0.71 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: -1.48 |

| Estmated Long-Term EPS Growth Rate: 13.36% |

Last Dividend Paid: 12/01/2025 - $0.83 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |