| Zacks Company Profile for Skyworks Solutions, Inc. (SWKS : NSDQ) |

|

|

| |

| • Company Description |

| Skyworks Solutions Inc. designs, manufactures, and markets a broad range of high-performance analog and mixed signal semiconductors that enable wireless connectivity. The company's products include power amplifiers (PAs), front-end modules (FEMs), radio frequency (RF) sub-systems, and cellular systems. Leveraging its core analog technologies, the company also offers a diverse portfolio of linear integrated circuits (ICs) that support automotive, broadband, cellular infrastructure, industrial and medical applications. The company has designed its product portfolio around two markets: cellular handsets and analog semiconductors.

Number of Employees: 10,000 |

|

|

| |

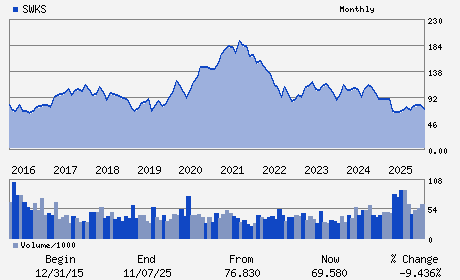

| • Price / Volume Information |

| Yesterday's Closing Price: $59.58 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,541,935 shares |

| Shares Outstanding: 150.37 (millions) |

| Market Capitalization: $8,959.26 (millions) |

| Beta: 1.30 |

| 52 Week High: $90.90 |

| 52 Week Low: $47.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.85% |

7.79% |

| 12 Week |

-14.05% |

-14.16% |

| Year To Date |

-6.04% |

-6.50% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Philip G. Brace - Chief Executive Officer and President

Philip Carter - Senior Vice President and Chief Financial Officer

Alan S. Batey - Director

Kevin L. Beebe - Director

Eric J. Guerin - Director

|

|

Peer Information

Skyworks Solutions, Inc. (PRKR)

Skyworks Solutions, Inc. (SWKS)

Skyworks Solutions, Inc. (NOIZ)

Skyworks Solutions, Inc. (TWER)

Skyworks Solutions, Inc. (MDIA)

Skyworks Solutions, Inc. (RESN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Semi-Radio Freq

Sector: Computer and Technology

CUSIP: 83088M102

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 150.37

Most Recent Split Date: 4.00 (2.00:1)

Beta: 1.30

Market Capitalization: $8,959.26 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.77% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.68 |

Indicated Annual Dividend: $2.84 |

| Current Fiscal Year EPS Consensus Estimate: $3.27 |

Payout Ratio: 0.64 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.25 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/24/2026 - $0.71 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |