| Zacks Company Profile for Atlassian Corporation PLC (TEAM : NSDQ) |

|

|

| |

| • Company Description |

| Atlassian is a global leader and innovator in the enterprise collaboration and workflow software space. The company offers a suite of cloud-based software solutions, which help organizations, collaborate and manage their workforce, such that the teams work better together.Initially, Atlassian's products were designed to help software developer teams communicate, collaborate, and manage the design and delivery cycle of software. However, over the years, uses of Atlassian's solutions have expanded virally to teams across diverse industries. With its sustained focus on developing new collaboration tools, the company now caters to the need of several corporate functions, including finance, legal, human resource and IT support.

Number of Employees: 13,813 |

|

|

| |

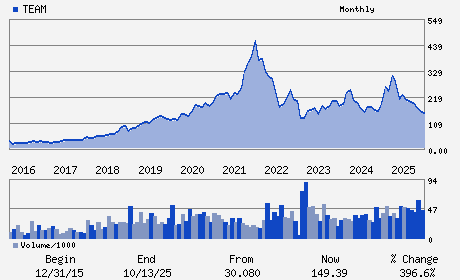

| • Price / Volume Information |

| Yesterday's Closing Price: $75.13 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,922,792 shares |

| Shares Outstanding: 263.74 (millions) |

| Market Capitalization: $19,815.09 (millions) |

| Beta: 0.94 |

| 52 Week High: $287.26 |

| 52 Week Low: $67.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-36.43% |

-35.87% |

| 12 Week |

-52.85% |

-52.90% |

| Year To Date |

-53.66% |

-53.89% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael Cannon-Brookes - Chief Executive Officer and Director

Joseph Binz - Chief Financial Officer

Gene Liu - Chief Accounting Officer

Scott Belsky - Director

Karen Dykstra - Director

|

|

Peer Information

Atlassian Corporation PLC (ADP)

Atlassian Corporation PLC (CWLD)

Atlassian Corporation PLC (CYBA.)

Atlassian Corporation PLC (ZVLO)

Atlassian Corporation PLC (AZPN)

Atlassian Corporation PLC (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 049468101

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 263.74

Most Recent Split Date: (:1)

Beta: 0.94

Market Capitalization: $19,815.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.10 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.06 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 20.66% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |