| Zacks Company Profile for Terex Corporation (TEX : NYSE) |

|

|

| |

| • Company Description |

| Terex Corporation is a global manufacturer of aerial work platforms, materials processing machinery and cranes. It designs, build and support products used in construction, maintenance, manufacturing, energy, minerals and materials management applications. The company's manufacturing facilities are located in the United States, Canada, Europe, Australia, Asia and South America. Terex sells its products through a worldwide distribution network. Terex also offers a complete line of financial products and services to assist in the acquisition of equipment through Terex Financial Services.

Number of Employees: 10,700 |

|

|

| |

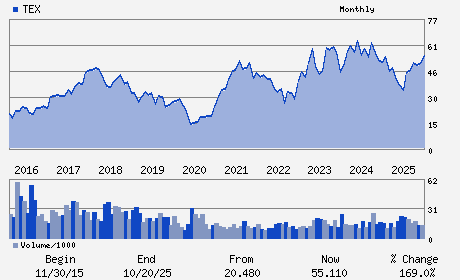

| • Price / Volume Information |

| Yesterday's Closing Price: $68.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,914,277 shares |

| Shares Outstanding: 113.70 (millions) |

| Market Capitalization: $7,821.42 (millions) |

| Beta: 1.62 |

| 52 Week High: $71.50 |

| 52 Week Low: $31.53 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

20.68% |

21.74% |

| 12 Week |

38.05% |

37.88% |

| Year To Date |

28.87% |

28.24% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Simon A. Meester - President; Chief Executive Officer and Director

David A. Sachs - Non-Executive Chairman

Jennifer Kong-Picarello - Senior Vice President and Chief Financial Officer

Stephen A. Johnston - Vice President; Chief Accounting Officer and Contr

David Dauch - Director

|

|

Peer Information

Terex Corporation (ASTE)

Terex Corporation (EMAT)

Terex Corporation (MTW)

Terex Corporation (KMTUY)

Terex Corporation (JOY)

Terex Corporation (CMI.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-CONST/MNG

Sector: Industrial Products

CUSIP: 880779103

SIC: 3537

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/01/26

|

|

Share - Related Items

Shares Outstanding: 113.70

Most Recent Split Date: 7.00 (2.00:1)

Beta: 1.62

Market Capitalization: $7,821.42 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.99% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.77 |

Indicated Annual Dividend: $0.68 |

| Current Fiscal Year EPS Consensus Estimate: $4.83 |

Payout Ratio: 0.14 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.01 |

| Estmated Long-Term EPS Growth Rate: 10.21% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/01/26 |

|

|

|

| |