| Zacks Company Profile for Tredegar Corporation (TG : NYSE) |

|

|

| |

| • Company Description |

| Tredegar Corporation is a publicly traded company that manufactures plastic films and aluminum extrusions. It operates through PE Films, Flexible Packaging Films and Aluminum Extrusions segments. The PE Films segment offers personal care materials, such as apertured films and laminate materials for use in feminine hygiene products, baby diapers, and adult incontinence products under the ComfortAire, ComfortFeel and FreshFeel brands. The Flexible Packaging Films segment offers polyester-based films for food packaging and industrial applications under the Terphane and Sealphane brands. The Aluminum Extrusions segment produces soft-alloy and medium-strength aluminum extrusions primarily for building and construction, automotive, consumer durables, machinery and equipment, electrical, and distribution markets; and manufactures mill, anodized, and painted and fabricated aluminum extrusions to fabricators and distributors.

Number of Employees: 1,500 |

|

|

| |

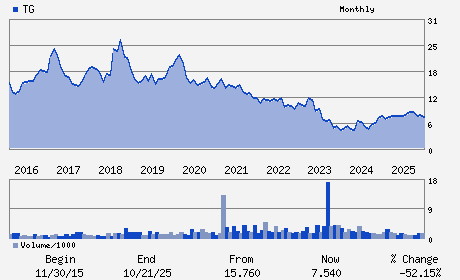

| • Price / Volume Information |

| Yesterday's Closing Price: $9.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 146,908 shares |

| Shares Outstanding: 34.91 (millions) |

| Market Capitalization: $320.48 (millions) |

| Beta: 0.63 |

| 52 Week High: $9.43 |

| 52 Week Low: $6.25 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.37% |

8.31% |

| 12 Week |

21.59% |

21.44% |

| Year To Date |

27.85% |

27.24% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John M. Steitz - President; Chief Executive Officer and Director

Gregory A. Pratt - Chairman

D. Andrew Edwards - Executive Vice President and Chief Financial Offic

Frasier W. Brickhouse - Corporate Treasurer and Controller

George C. Freeman - Director

|

|

Peer Information

Tredegar Corporation (BYH)

Tredegar Corporation (JSCPY)

Tredegar Corporation (TSSS)

Tredegar Corporation (ICOC)

Tredegar Corporation (PTPIY)

Tredegar Corporation (MRCFQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-PLASTICS

Sector: Basic Materials

CUSIP: 894650100

SIC: 3350

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/11/26

|

|

Share - Related Items

Shares Outstanding: 34.91

Most Recent Split Date: 7.00 (3.00:1)

Beta: 0.63

Market Capitalization: $320.48 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.42 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/11/26 |

|

|

|

| |