| Zacks Company Profile for Team, Inc. (TISI : NYSE) |

|

|

| |

| • Company Description |

| Team, Inc. is a professional, full-service provider of specialty industrial services. Team's current industrial service offering encompasses on-stream leak repair, hot tapping, fugitive emissions monitoring, field machining, technical bolting, field valve repair, NDE inspection and field heat treating. All these services are required in maintaining high temperature, high pressure piping systems and vessels utilized extensively in the refining, petrochemical, power, pipeline, and other heavy industries. Team's inspection services also serve the aerospace and automotive industries.

Number of Employees: 5,400 |

|

|

| |

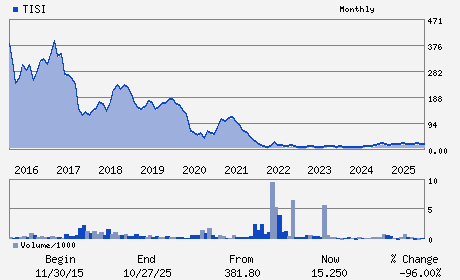

| • Price / Volume Information |

| Yesterday's Closing Price: $14.70 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,306 shares |

| Shares Outstanding: 4.53 (millions) |

| Market Capitalization: $66.56 (millions) |

| Beta: 1.11 |

| 52 Week High: $24.25 |

| 52 Week Low: $12.12 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.88% |

2.77% |

| 12 Week |

0.69% |

0.57% |

| Year To Date |

4.04% |

3.54% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Keith D. Tucker - Chief Executive Officer

Michael J. Caliel - Chairman and Director

Nelson M. Haight - Chief Financial Officer

Matthew E. Acosta - Vice President and Chief Accounting Officer

J. Michael Anderson - Director

|

|

Peer Information

Team, Inc. (DWYR)

Team, Inc. (ESR.)

Team, Inc. (SNR.)

Team, Inc. (TISI)

Team, Inc. (HWRK)

Team, Inc. (SWSH.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-MAINT & SV

Sector: Construction

CUSIP: 878155308

SIC: 7600

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/18/26

|

|

Share - Related Items

Shares Outstanding: 4.53

Most Recent Split Date: 12.00 (0.10:1)

Beta: 1.11

Market Capitalization: $66.56 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/18/26 |

|

|

|

| |