| Zacks Company Profile for The TJX Companies, Inc. (TJX : NYSE) |

|

|

| |

| • Company Description |

| The TJX Companies, Inc. is a leading off-price retailer of apparel and home fashions in the U.S. and worldwide. The company's broad range of assortments at varying prices helps it to reach out to a broad range of consumers. In addition to these, The TJX Companies tries to attract consumers through rapid turn of inventories. The company has been able to distinguish itself from traditional retailers on the grounds of opportunistic buying strategies and flexible business model. The TJX Companies' low-cost structure sets it apart from other traditional retailers. In order to maintain control on costs, the company engages in the promotion of retail banners, rather than specific brands. The company's distribution network is also designed in a manner such that helps curtailing costs. Moreover, the company emphasizes on creating strong relations with vendors across different countries.

Number of Employees: 364,000 |

|

|

| |

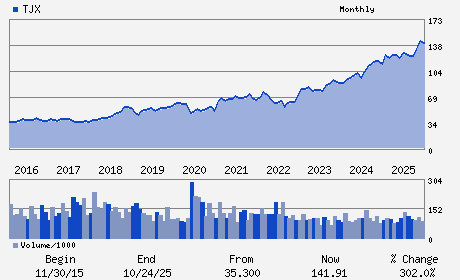

| • Price / Volume Information |

| Yesterday's Closing Price: $159.94 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,201,350 shares |

| Shares Outstanding: 1,110.47 (millions) |

| Market Capitalization: $177,608.09 (millions) |

| Beta: 0.73 |

| 52 Week High: $162.68 |

| 52 Week Low: $112.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.51% |

7.97% |

| 12 Week |

4.05% |

3.52% |

| Year To Date |

4.12% |

3.57% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ernie Herrman - Chief Executive Officer and President

Carol Meyrowitz - Executive Chairman

John Klinger - Chief Financial Officer

Kenneth Canestrari - Senior Executive Vice President

David T. Ching - Director

|

|

Peer Information

The TJX Companies, Inc. (TGT)

The TJX Companies, Inc. (BURL)

The TJX Companies, Inc. (ALCSQ)

The TJX Companies, Inc. (CLDRQ)

The TJX Companies, Inc. (BLEEQ)

The TJX Companies, Inc. (FDO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-DISCOUNT

Sector: Retail/Wholesale

CUSIP: 872540109

SIC: 5651

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/20/26

|

|

Share - Related Items

Shares Outstanding: 1,110.47

Most Recent Split Date: 11.00 (2.00:1)

Beta: 0.73

Market Capitalization: $177,608.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.06% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.00 |

Indicated Annual Dividend: $1.70 |

| Current Fiscal Year EPS Consensus Estimate: $5.05 |

Payout Ratio: 0.36 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 8.60% |

Last Dividend Paid: 02/12/2026 - $0.43 |

| Next EPS Report Date: 05/20/26 |

|

|

|

| |