| Zacks Company Profile for ThyssenKrupp AG Sponsored ADR (TKAMY : OTC) |

|

|

| |

| • Company Description |

| ThyssenKrupp AG engages in the production of steel. It operates through the following business areas Components Technology, Elevator Technology, Industrial Solutions, Materials Services, Steel Europe and Steel Americas. Components Technology business area offers components for the automotive, construction and engineering sectors. Elevator Technology business area constructs and modernizes elevators, escalators, moving walks, stair and platform lifts, and passenger boarding bridges. Industrial Solutions business area is an international supplier in special and large-scale plant construction as well as naval shipbuilding. Materials Services business area distributes materials and provides complex technical services for the production and manufacturing sectors. Steel Europe business area involves in the flat carbon steel activities. Steel America business area produces, processes, and markets steel products in North and South America. ThyssenKrupp AG is headquartered in Essen, Germany.

Number of Employees: 93,375 |

|

|

| |

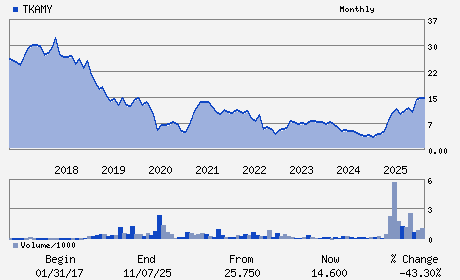

| • Price / Volume Information |

| Yesterday's Closing Price: $12.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 45,629 shares |

| Shares Outstanding: 622.53 (millions) |

| Market Capitalization: $7,725.62 (millions) |

| Beta: 1.00 |

| 52 Week High: $17.02 |

| 52 Week Low: $8.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.34% |

-5.52% |

| 12 Week |

13.47% |

13.33% |

| Year To Date |

14.91% |

14.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Miguel Angel Lopez - Chief Executive Officer

Siegfried Russwurm - Chairman

Jens Schulte - Chief Financial Officer

Oliver Burkhard - Director

Klaus Keysberg - Director

|

|

Peer Information

ThyssenKrupp AG Sponsored ADR (M.DFS)

ThyssenKrupp AG Sponsored ADR (ARBD.)

ThyssenKrupp AG Sponsored ADR (FSTR)

ThyssenKrupp AG Sponsored ADR (HLESF)

ThyssenKrupp AG Sponsored ADR (HLETY)

ThyssenKrupp AG Sponsored ADR (T.RUS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: STEEL-PRODUCERS

Sector: Basic Materials

CUSIP: 88629Q207

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/21/26

|

|

Share - Related Items

Shares Outstanding: 622.53

Most Recent Split Date: (:1)

Beta: 1.00

Market Capitalization: $7,725.62 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.92% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.11 |

| Current Fiscal Year EPS Consensus Estimate: $0.33 |

Payout Ratio: 0.06 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.07 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/03/2026 - $0.11 |

| Next EPS Report Date: 05/21/26 |

|

|

|

| |