| Zacks Company Profile for Toyota Motor Corporation (TM : NYSE) |

|

|

| |

| • Company Description |

| Toyota Motor Corporation is one of the leading automakers in the world in terms of sales and production. Its product portfolio consists of a full range of models from passenger cars and minivans to trucks as well as related parts and accessories. Apart from combustion-engine vehicles, the company is also working on fuel cell and automated vehicles. It plans to offer a committed electrified model or an electrified option for customers of Toyota or Lexus model by 2025. The company's operations are classified into three segments Automotive, Financial Services and All Other.Toyota's?Automotive?business caters to its domestic market as well as markets in North America, Europe, Asia and other regions that include the Middle East. Toyota has R&D centers across the United States, Japan, China and Europe that are used to develop advanced and upgraded vehicles. Further, the company has several manufacturing facilities across the globe that produces vehicle brands ' including Toyota, Lexus, Hino and Daihatsu.

Number of Employees: 383,853 |

|

|

| |

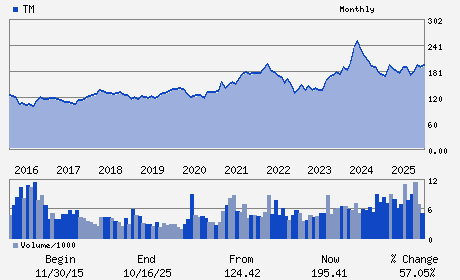

| • Price / Volume Information |

| Yesterday's Closing Price: $242.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 278,734 shares |

| Shares Outstanding: 1,303.34 (millions) |

| Market Capitalization: $315,903.22 (millions) |

| Beta: 0.60 |

| 52 Week High: $248.90 |

| 52 Week Low: $155.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.84% |

7.78% |

| 12 Week |

23.31% |

23.16% |

| Year To Date |

13.23% |

12.68% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1 TOYOTA CHO AICHI PREFECTURE

-

TOYOTA,M0 471-8571

JPN |

ph: 815-6528-2121

fax: 815-6523-5800 |

None |

None |

|

|

| |

| • General Corporate Information |

Officers

Akio Toyoda - Chairman

Koji Sato - President

Hiroki Nakajima - Executive Vice President

Yoichi Miyazaki - Executive Vice President

Shigeaki Okamoto - Director

|

|

Peer Information

Toyota Motor Corporation (DIN.L)

Toyota Motor Corporation (SSM)

Toyota Motor Corporation (FIATY)

Toyota Motor Corporation (FUJHY)

Toyota Motor Corporation (BAMXF)

Toyota Motor Corporation (BRDCY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO -FOREIGN

Sector: Auto/Tires/Trucks

CUSIP: 892331307

SIC: 3711

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 1,303.34

Most Recent Split Date: 6.00 (1.10:1)

Beta: 0.60

Market Capitalization: $315,903.22 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.10% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $5.10 |

| Current Fiscal Year EPS Consensus Estimate: $18.74 |

Payout Ratio: 0.27 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |