| Zacks Company Profile for Trimble Inc. (TRMB : NSDQ) |

|

|

| |

| • Company Description |

| Trimble Inc. is an original equipment manufacturer of positioning, surveying and machine control products. Its product portfolio is centered on the integration of real-time positioning or location technologies with wireless communications and software or information technologies. The company leverages Global Positioning System, Global Navigation Satellite Systems, augmentation systems and other systems based on optical and laser technologies, in order to provide real-time position. The company offers enterprise and mobility solutions for long-haul trucking industry. Further, it offers comprehensive fleet and transportation management, analytics, routing, mapping, reporting, and predictive modeling solutions for logistics market. The company sells its products through direct channels, joint ventures, representatives, dealers and other channels.

Number of Employees: 11,500 |

|

|

| |

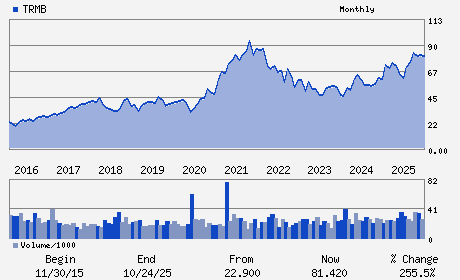

| • Price / Volume Information |

| Yesterday's Closing Price: $66.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,294,618 shares |

| Shares Outstanding: 233.93 (millions) |

| Market Capitalization: $15,642.86 (millions) |

| Beta: 1.57 |

| 52 Week High: $87.50 |

| 52 Week Low: $52.91 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.08% |

-0.21% |

| 12 Week |

-19.93% |

-20.03% |

| Year To Date |

-14.65% |

-15.07% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert G. Painter - President; Chief Executive Officer; Director

Phillip Sawarynski - Chief Financial Officer

Kenneth B. Bement - Chief Accounting Officer

James C. Dalton - Director

Borje Ekholm - Director

|

|

Peer Information

Trimble Inc. (B.)

Trimble Inc. (DXPE)

Trimble Inc. (AIT)

Trimble Inc. (GDI.)

Trimble Inc. (CTITQ)

Trimble Inc. (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 896239100

SIC: 3829

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 233.93

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.57

Market Capitalization: $15,642.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.58 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.00 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |