| Zacks Company Profile for Transcat, Inc. (TRNS : NSDQ) |

|

|

| |

| • Company Description |

| Transcat, Inc. distributes test and measurement instruments and provides accredited calibration services to a variety of industries including life sciences, pharmaceutical, petroleum refining, chemical manufacturing, public utility, pulp and paper, communications, automotive and aerospace.

Number of Employees: 1,245 |

|

|

| |

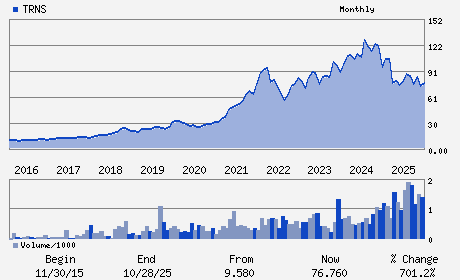

| • Price / Volume Information |

| Yesterday's Closing Price: $80.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 194,346 shares |

| Shares Outstanding: 9.33 (millions) |

| Market Capitalization: $753.39 (millions) |

| Beta: 0.71 |

| 52 Week High: $97.08 |

| 52 Week Low: $50.23 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

28.02% |

29.78% |

| 12 Week |

54.83% |

54.04% |

| Year To Date |

42.31% |

41.56% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Lee D. Rudow - President and Chief Executive Officer

Gary J. Haseley - Chairman

Thomas L. Barbato - Senior Vice President of Finance and Chief Financi

Scott D. Deverell - Controller and Principal Accounting Officer

Craig D. Cairns - Director

|

|

Peer Information

Transcat, Inc. (BEIQ)

Transcat, Inc. (THR)

Transcat, Inc. (EDCO)

Transcat, Inc. (TRCI)

Transcat, Inc. (MOCO)

Transcat, Inc. (ACSEF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INSTRU-CONTROL

Sector: Computer and Technology

CUSIP: 893529107

SIC: 3825

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/18/26

|

|

Share - Related Items

Shares Outstanding: 9.33

Most Recent Split Date: 7.00 (2.00:1)

Beta: 0.71

Market Capitalization: $753.39 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.51 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.83 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/18/26 |

|

|

|

| |