| Zacks Company Profile for TDK Corp. (TTDKY : OTC) |

|

|

| |

| • Company Description |

| TDK Corp. has a portfolio of technologies originally developed for its businesses involving electronic materials, components and devices, semiconductor, recording media and data storage devices. Its technical leadership includes materials research and development for dielectric, organic and semiconductor materials, process technologies for thick and thin film, metal, semiconductors and integration technologies. TDK technologies can be found in multimedia, video, television, personal computers, mobile communications, and semiconductors. (PRESS RELEASE)

Number of Employees: 105,067 |

|

|

| |

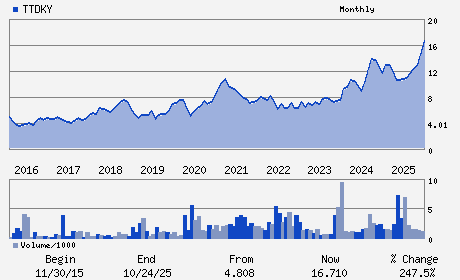

| • Price / Volume Information |

| Yesterday's Closing Price: $14.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 461,463 shares |

| Shares Outstanding: 1,943.86 (millions) |

| Market Capitalization: $28,716.63 (millions) |

| Beta: 0.76 |

| 52 Week High: $18.51 |

| 52 Week Low: $8.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.52% |

6.98% |

| 12 Week |

-5.24% |

-5.72% |

| Year To Date |

4.77% |

4.22% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Nihonbashi Takashimaya Mitsui Building 2-5-1 Nihonbashi Chuo-ku

-

Tokyo,M0 103-6128

JPN |

ph: 813-6778-1068

fax: - |

None |

http://www.tdk.com |

|

|

| |

| • General Corporate Information |

Officers

Noboru Saito - Chief Executive Officer and President

Mutsuo Iwai - Chairman

Tetsuji Yamanishi - Senior Vice President

Kozue Nakayama - Director

Shoei Yamana - Director

|

|

Peer Information

TDK Corp. (SMTI.)

TDK Corp. (DDICQ)

TDK Corp. (CGGIQ)

TDK Corp. (CRDN)

TDK Corp. (CDTS)

TDK Corp. (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: 872351408

SIC: 3695

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 1,943.86

Most Recent Split Date: 10.00 (5.00:1)

Beta: 0.76

Market Capitalization: $28,716.63 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.83% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.11 |

Indicated Annual Dividend: $0.12 |

| Current Fiscal Year EPS Consensus Estimate: $0.71 |

Payout Ratio: 0.19 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 13.85% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |