| Zacks Company Profile for TTM Technologies, Inc. (TTMI : NSDQ) |

|

|

| |

| • Company Description |

| TTM Technologies, Inc. is a leading global printed circuit board manufacturer, focusing on quick-turn and volume production of technologically advanced PCBs, backplane assemblies and electro-mechanical solutions. TTM stands for time-to-market, representing how TTM's time-critical, one-stop manufacturing services enable customers to shorten the time required to develop new products and bring them to market.

Number of Employees: 18,200 |

|

|

| |

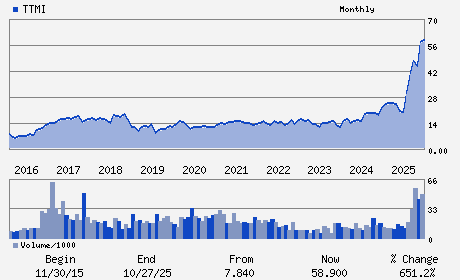

| • Price / Volume Information |

| Yesterday's Closing Price: $113.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,190,372 shares |

| Shares Outstanding: 103.40 (millions) |

| Market Capitalization: $11,684.76 (millions) |

| Beta: 1.74 |

| 52 Week High: $113.46 |

| 52 Week Low: $16.55 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.97% |

11.48% |

| 12 Week |

49.81% |

49.04% |

| Year To Date |

63.77% |

62.91% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

200 EAST SANDPOINTE SUITE 400

-

SANTA ANA,CA 92707

USA |

ph: 714-327-3000

fax: 302-655-5049 |

sean.hannan@ttmtech.com |

http://www.ttm.com |

|

|

| |

| • General Corporate Information |

Officers

Edwin Roks - President; Chief Executive Officer; and Director

Rex D. Geveden - Chairman

Daniel L. Boehle - Executive Vice President and Chief Financial Off

Wajid Ali - Director

Thomas T. Edman - Director

|

|

Peer Information

TTM Technologies, Inc. (SMTI.)

TTM Technologies, Inc. (DDICQ)

TTM Technologies, Inc. (CGGIQ)

TTM Technologies, Inc. (CRDN)

TTM Technologies, Inc. (CDTS)

TTM Technologies, Inc. (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: 87305R109

SIC: 3672

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 103.40

Most Recent Split Date: (:1)

Beta: 1.74

Market Capitalization: $11,684.76 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.58 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.93 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |