| Zacks Company Profile for Twilio Inc. (TWLO : NYSE) |

|

|

| |

| • Company Description |

| Twilio Inc. provides Cloud Communications Platform-as-a-Service. The company enables developers to build, scale and operate real-time communications within software applications. The company's platform consists of three layers, Engagement Cloud, Programmable Communications Cloud and Super Network. Twilio's Programmable Communications Cloud software allows developers to embed voice, messaging, video and authentication capabilities. The company runs a cloud-based Application Programming Interfaces or API, which allows software developers to programmatically make and receive phone calls, text messages and video chats. The advantage of this is that now small app developers can add rich communications features to their apps at a very low cost. By using Twilio's software, companies can develop such embed communication applications and website that will help them better connect with end customers.

Number of Employees: 5,587 |

|

|

| |

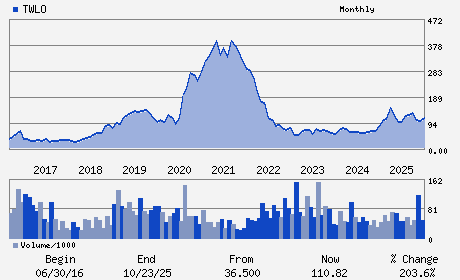

| • Price / Volume Information |

| Yesterday's Closing Price: $120.96 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,117,850 shares |

| Shares Outstanding: 153.43 (millions) |

| Market Capitalization: $18,559.33 (millions) |

| Beta: 1.30 |

| 52 Week High: $145.90 |

| 52 Week Low: $77.51 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.42% |

1.29% |

| 12 Week |

-5.00% |

-5.11% |

| Year To Date |

-14.96% |

-15.37% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

101 SPEAR STREET FIFTH FLOOR

-

SAN FRANCISCO,CA 94105

USA |

ph: 415-390-2337

fax: - |

ir@twilio.com |

http://www.twilio.com |

|

|

| |

| • General Corporate Information |

Officers

Khozema Z. Shipchandler - Director and Chief Executive Officer

Aidan Viggiano - Chief Financial Officer

Charlie Bell - Director

Donna L. Dubinsky - Director

Jeff Epstein - Director

|

|

Peer Information

Twilio Inc. (ADP)

Twilio Inc. (CWLD)

Twilio Inc. (CYBA.)

Twilio Inc. (ZVLO)

Twilio Inc. (AZPN)

Twilio Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 90138F102

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 153.43

Most Recent Split Date: (:1)

Beta: 1.30

Market Capitalization: $18,559.33 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.56 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.47 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 9.86% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |