| Zacks Company Profile for Texas Roadhouse, Inc. (TXRH : NSDQ) |

|

|

| |

| • Company Description |

| Texas Roadhouse, Inc. is a full-service, casual dining restaurant chain, which offers assorted seasoned and aged steaks hand-cut daily on the premises and cooked to order over open gas-fired grills. It operates restaurants under the Texas Roadhouse and Aspen Creek names. The firm also offers its guests a selection of ribs, fish, seafood, chicken, pork chops, pulled pork and vegetable plates, an assortment of hamburgers, salads and sandwiches. It also provides supervisory and administrative services for other license and franchise restaurants.

Number of Employees: 95,000 |

|

|

| |

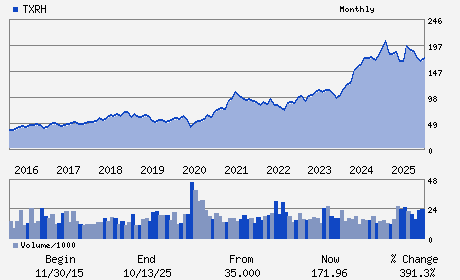

| • Price / Volume Information |

| Yesterday's Closing Price: $180.19 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,048,840 shares |

| Shares Outstanding: 66.15 (millions) |

| Market Capitalization: $11,918.86 (millions) |

| Beta: 0.86 |

| 52 Week High: $199.99 |

| 52 Week Low: $148.73 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.32% |

0.04% |

| 12 Week |

9.17% |

8.62% |

| Year To Date |

8.55% |

7.98% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Gerald L. Morgan - Chief Executive Officer and Executive Vice Chairma

Gregory N. Moore - Chairman

Michael S. Lenihan - Chief Financial Officer

Keith V. Humpich - Chief Accounting and Financial Services Officer

Jane Grote Abell - Director

|

|

Peer Information

Texas Roadhouse, Inc. (BH)

Texas Roadhouse, Inc. (BUCA)

Texas Roadhouse, Inc. (BUNZQ)

Texas Roadhouse, Inc. (FRRG)

Texas Roadhouse, Inc. (CHEF.)

Texas Roadhouse, Inc. (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: 882681109

SIC: 5812

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 66.15

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.86

Market Capitalization: $11,918.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.51% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.85 |

Indicated Annual Dividend: $2.72 |

| Current Fiscal Year EPS Consensus Estimate: $6.35 |

Payout Ratio: 0.45 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 14.54% |

Last Dividend Paid: 12/02/2025 - $0.68 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |