| Zacks Company Profile for UbiSoft Entertainment Inc. (UBSFY : OTC) |

|

|

| |

| • Company Description |

| Ubisoft Entertainment operates in parts of Europe, Canada and the United States and its primary activities are the production, publishing and distribution of interactive entertainment products. Products include video games, educational and cultural software, cartoons, literary, multimedia, audio-visual products, cinematographic and television works. Some of its brands are Driver, Anno, Endwar and Tom Clancy.

Number of Employees: 17,782 |

|

|

| |

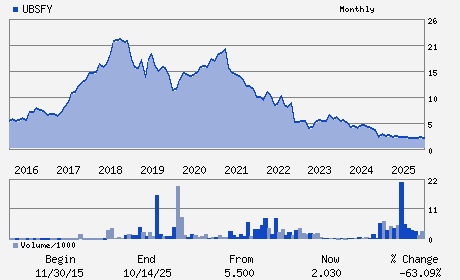

| • Price / Volume Information |

| Yesterday's Closing Price: $0.91 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 269,460 shares |

| Shares Outstanding: 673.64 (millions) |

| Market Capitalization: $613.55 (millions) |

| Beta: -0.12 |

| 52 Week High: $3.35 |

| 52 Week Low: $0.88 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.15% |

-3.85% |

| 12 Week |

-33.28% |

-33.62% |

| Year To Date |

-37.19% |

-37.52% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2 Rue Du Chene Heleuc

-

Carentoir Cedex 2,I0 56910

FRA |

ph: 33-01-48-18-50-00

fax: 33-01-48-57-07-41 |

ir@ubisoft.fr |

http://www.ubisoft.com |

|

|

| |

| • General Corporate Information |

Officers

Yves Guillemot - Chairman and Chief Executive Officer

Cecile Russeil - Executive Vice President

Olfa Zorgati - Director

Katherine Hays - Director

Claude France - Director

|

|

Peer Information

UbiSoft Entertainment Inc. (CHLD.)

UbiSoft Entertainment Inc. (FGRD)

UbiSoft Entertainment Inc. (CGMI.)

UbiSoft Entertainment Inc. (AGAM.)

UbiSoft Entertainment Inc. (ASCA.)

UbiSoft Entertainment Inc. (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 90348R102

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 673.64

Most Recent Split Date: (:1)

Beta: -0.12

Market Capitalization: $613.55 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.60 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |