| Zacks Company Profile for United-Guardian, Inc. (UG : NSDQ) |

|

|

| |

| • Company Description |

| UNITED GUARDIAN conducts research, product development, manufacturing and marketing of pharmaceuticals, cosmetics, health care products, medical devices, and proprietary industrial products. They also distributes a line of over 3,000 fine organic chemicals, research chemicals, test solutions, indicators, dyes and reagents.

Number of Employees: 25 |

|

|

| |

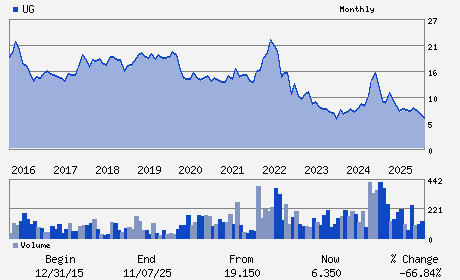

| • Price / Volume Information |

| Yesterday's Closing Price: $6.72 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 11,785 shares |

| Shares Outstanding: 4.59 (millions) |

| Market Capitalization: $30.87 (millions) |

| Beta: 1.01 |

| 52 Week High: $10.29 |

| 52 Week Low: $5.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.80% |

-5.98% |

| 12 Week |

11.63% |

11.49% |

| Year To Date |

9.09% |

8.56% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

230 MARCUS BOULEVARD

-

HAUPPAUGE,NY 11788

USA |

ph: 631-273-0900

fax: 631-273-0858 |

None |

http://www.u-g.com |

|

|

| |

| • General Corporate Information |

Officers

Ken Globus - Chairman

Donna Vigilante - President

Andrea Young - Chief Financial Officer

Lawrence F. Maietta - Director

Arthur M. Dresner - Director

|

|

Peer Information

United-Guardian, Inc. (BJCT)

United-Guardian, Inc. (CADMQ)

United-Guardian, Inc. (APNO)

United-Guardian, Inc. (UPDC)

United-Guardian, Inc. (IMTIQ)

United-Guardian, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 910571108

SIC: 2844

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/20/26

|

|

Share - Related Items

Shares Outstanding: 4.59

Most Recent Split Date: (:1)

Beta: 1.01

Market Capitalization: $30.87 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.44% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.50 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 1.16 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.16 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/09/2026 - $0.25 |

| Next EPS Report Date: 03/20/26 |

|

|

|

| |