| Zacks Company Profile for Urban Outfitters, Inc. (URBN : NSDQ) |

|

|

| |

| • Company Description |

| Urban Outfitters Inc. is a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home d?cor and gifts products. The company's merchandises are generally sold directly to consumers through stores, catalogs, call centers and e-commerce platforms. The company has operations in the U.S., Canada & Europe. It reports through 2 segments: Retail segment, comprising brands slike Urban Outfitters, Anthropologie, Free People, Terrain and BHLDN, and Wholesale segment, engaged in designing and marketing contemporary casual attire for women. Free People, Anthropologie Group and Urban Outfitters wholesale sell their products through multiple departments and specialty stores worldwide, digital businesses and the Company's Retail segment.

Number of Employees: 29,000 |

|

|

| |

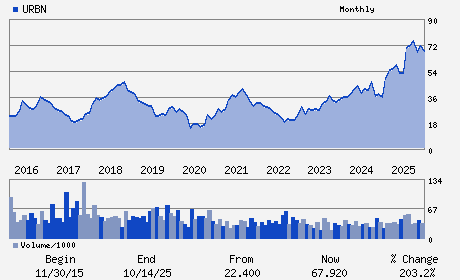

| • Price / Volume Information |

| Yesterday's Closing Price: $65.85 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,483,521 shares |

| Shares Outstanding: 89.68 (millions) |

| Market Capitalization: $5,905.36 (millions) |

| Beta: 1.22 |

| 52 Week High: $84.35 |

| 52 Week Low: $41.89 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.26% |

-7.91% |

| 12 Week |

-14.36% |

-14.06% |

| Year To Date |

-12.50% |

-12.13% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Richard A. Hayne - Chairman of the Board and Chief Executive Officer

Francis J. Conforti - Co-President and Chief Operating Officer

Melanie Marein-Efron - Chief Financial Officer

Margaret A. Hayne - Co-President and Chief Creative Officer

Edward N. Antoian - Director

|

|

Peer Information

Urban Outfitters, Inc. (CACH)

Urban Outfitters, Inc. (DXLG)

Urban Outfitters, Inc. (HIBB)

Urban Outfitters, Inc. (WALKQ)

Urban Outfitters, Inc. (BDST)

Urban Outfitters, Inc. (CBKCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-APP/SHOE

Sector: Retail/Wholesale

CUSIP: 917047102

SIC: 5651

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/20/26

|

|

Share - Related Items

Shares Outstanding: 89.68

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.22

Market Capitalization: $5,905.36 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.13 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.83 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 8.88% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/20/26 |

|

|

|

| |