| Zacks Company Profile for Veeco Instruments Inc. (VECO : NSDQ) |

|

|

| |

| • Company Description |

| Veeco Instruments Inc. is engaged in the design, development, manufacture and support of thin film process equipment, primarily sold to make electronic devices. Veeco's process equipment solutions enable the manufacture of LEDs, power electronics, hard drives, MEMS and wireless chips. They are the market leader in MOCVD, MBE, Ion Beam and other advanced thin film process technologies. The Company's portfolio of technology solutions focus on market areas, including Lighting, Display & Power Electronics; Advanced Packaging, micro-electromechanical systems (MEMS) & radio frequency (RF); Scientific & Industrial, and Data Storage. The Company's System products include Metal Organic Chemical Vapor Deposition Systems, Precision Surface Processing Systems, Ion Beam Etch and Deposition Systems, Molecular Beam Epitaxy Systems, and Other Deposition and Industrial Products. The Company's original name `Veeco` stood for Vacuum Electronic Equipment Company.

Number of Employees: 1,265 |

|

|

| |

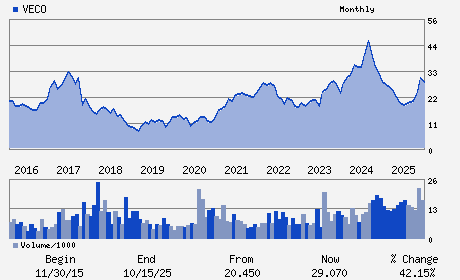

| • Price / Volume Information |

| Yesterday's Closing Price: $30.56 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,147,891 shares |

| Shares Outstanding: 60.39 (millions) |

| Market Capitalization: $1,845.58 (millions) |

| Beta: 1.17 |

| 52 Week High: $35.77 |

| 52 Week Low: $16.92 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.15% |

-1.29% |

| 12 Week |

-4.65% |

-4.77% |

| Year To Date |

6.93% |

6.41% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

William J. Miller - Chief Executive Officer and Director

Richard A. D'Amore - Chairman

John P. Kiernan - Senior Vice President and Chief Financial Officer

Kathleen A. Bayless - Director

Sujeet Chand - Director

|

|

Peer Information

Veeco Instruments Inc. (BESIY)

Veeco Instruments Inc. (NEXT2)

Veeco Instruments Inc. (EGLSQ)

Veeco Instruments Inc. (BTUI)

Veeco Instruments Inc. (DAWKQ)

Veeco Instruments Inc. (EMKR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MANUFT MACH

Sector: Computer and Technology

CUSIP: 922417100

SIC: 3559

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 60.39

Most Recent Split Date: (:1)

Beta: 1.17

Market Capitalization: $1,845.58 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.04 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.05 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |