| Zacks Company Profile for Venture Global, Inc. (VG : NYSE) |

|

|

| |

| • Company Description |

| Venture Global is a provider of U.S. LNG sourced from resource. The company's business includes assets across the LNG supply chain including LNG production, natural gas transport, shipping and regasification. Venture Global is based in ARLINGTON, Va.

Number of Employees: 1,500 |

|

|

| |

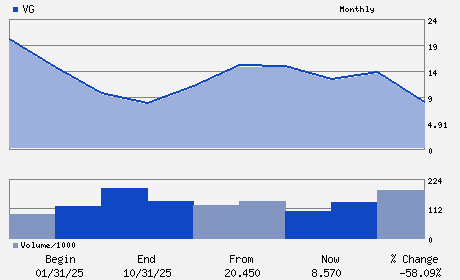

| • Price / Volume Information |

| Yesterday's Closing Price: $9.69 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,824,741 shares |

| Shares Outstanding: 2,448.11 (millions) |

| Market Capitalization: $23,722.19 (millions) |

| Beta: 5.67 |

| 52 Week High: $19.50 |

| 52 Week Low: $5.72 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.12% |

-0.26% |

| 12 Week |

42.08% |

41.91% |

| Year To Date |

42.08% |

41.39% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael Sabel - Chief Executive Officer; Director; Executive Co-Ch

Robert Pender - Executive Co-Chairman; Director and Founder

Jonathan Thayer - Chief Financial Officer

Sarah Blake - Chief Accounting Officer

Sari Granat - Director

|

|

Peer Information

Venture Global, Inc. (AEGG)

Venture Global, Inc. (CHAR)

Venture Global, Inc. (CECX.)

Venture Global, Inc. (DLOV)

Venture Global, Inc. (WACC)

Venture Global, Inc. (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 92333F101

SIC: 4924

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 2,448.11

Most Recent Split Date: (:1)

Beta: 5.67

Market Capitalization: $23,722.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.70% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.24 |

Indicated Annual Dividend: $0.07 |

| Current Fiscal Year EPS Consensus Estimate: $0.73 |

Payout Ratio: 0.09 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.02 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |