| Zacks Company Profile for Vicor Corporation (VICR : NSDQ) |

|

|

| |

| • Company Description |

| Vicor Corporation designs, manufactures and markets innovative, high performance modular power components, from bricks to semiconductor-centric solutions, to enable customers to efficiently convert and manage power from the wall plug to the point-of-load. Vicor offers comprehensive product lines addressing a broad range of power conversion and management requirements across all power distribution architectures, including CPA, DPA, IBA, FPA and CBA. Vicor focuses on solutions for performance-critical applications in the following markets: enterprise and high performance computing, telecommunications and network infrastructure, industrial equipment and automation, vehicles and transportation and aerospace and defense electronics. Vicor's holistic approach gives power system architects the flexibility to choose from modular, plug-and-play components ranging from bricks to semiconductor-centric solutions.

Number of Employees: 1,100 |

|

|

| |

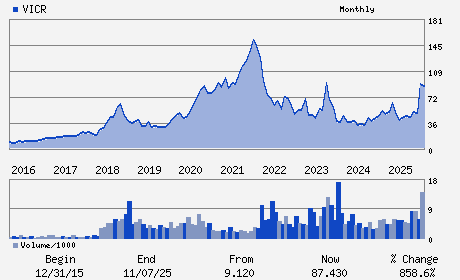

| • Price / Volume Information |

| Yesterday's Closing Price: $209.19 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 749,255 shares |

| Shares Outstanding: 44.65 (millions) |

| Market Capitalization: $9,340.88 (millions) |

| Beta: 1.84 |

| 52 Week High: $209.53 |

| 52 Week Low: $38.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

26.51% |

28.26% |

| 12 Week |

111.97% |

110.89% |

| Year To Date |

90.87% |

89.86% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Patrizio Vinciarelli - President; Chief Executive Officer and Chairman o

James F. Schmidt - Chief Financial Officer; Vice President and Direct

Estia J. Eichten - Director

Michael S. McNamara - Director

Samuel J. Anderson - Director

|

|

Peer Information

Vicor Corporation (SMTI.)

Vicor Corporation (DDICQ)

Vicor Corporation (CGGIQ)

Vicor Corporation (CRDN)

Vicor Corporation (CDTS)

Vicor Corporation (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: 925815102

SIC: 3679

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 44.65

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.84

Market Capitalization: $9,340.88 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.39 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.01 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |