| Zacks Company Profile for VNET Group, Inc. - Unsponsored ADR (VNET : NSDQ) |

|

|

| |

| • Company Description |

| VNET Group Inc. is a carrier and cloud neutral internet data center services provider principally in China. It provides hosting and related services, including IDC services, cloud services and business VPN services. VNET Group Inc., formerly known as 21Vianet Group Inc., is based in Beijing, China.

Number of Employees: 2,581 |

|

|

| |

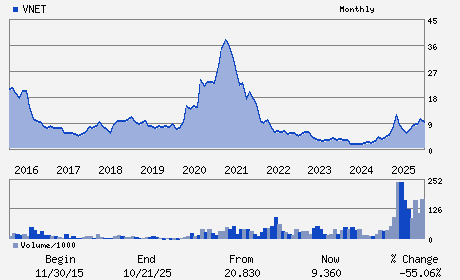

| • Price / Volume Information |

| Yesterday's Closing Price: $11.23 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,799,280 shares |

| Shares Outstanding: 268.93 (millions) |

| Market Capitalization: $3,020.07 (millions) |

| Beta: 0.01 |

| 52 Week High: $14.48 |

| 52 Week Low: $4.65 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.22% |

4.91% |

| 12 Week |

25.19% |

24.74% |

| Year To Date |

32.74% |

32.89% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Guanjie Building Southeast 1st Floor 10# Jiuxianqiao East Road

-

Beijing,F4 100016

CHN |

ph: 86-10-8456-2121

fax: 86-10-8456-4234 |

None |

http://www.21vianet.com |

|

|

| |

| • General Corporate Information |

Officers

Sheng Chen - Chief Executive Officer;Executive Chairperson

Qiyu Wang - Chief Financial Officer

Jianbiao Zhu - Co-Chairperson of the Board of Directors and Execu

Yoshihisa Ueno - Director

Kenneth Chung-Hou Tai - Director

|

|

Peer Information

VNET Group, Inc. - Unsponsored ADR (ADP)

VNET Group, Inc. - Unsponsored ADR (CWLD)

VNET Group, Inc. - Unsponsored ADR (CYBA.)

VNET Group, Inc. - Unsponsored ADR (ZVLO)

VNET Group, Inc. - Unsponsored ADR (AZPN)

VNET Group, Inc. - Unsponsored ADR (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 90138A103

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/11/26

|

|

Share - Related Items

Shares Outstanding: 268.93

Most Recent Split Date: (:1)

Beta: 0.01

Market Capitalization: $3,020.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.02 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.24 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 53.05% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/11/26 |

|

|

|

| |