| Zacks Company Profile for Viatris Inc. (VTRS : NSDQ) |

|

|

| |

| • Company Description |

| Viatris, Inc. is a global healthcare company. Its portfolio comprises more than thousand approved molecules across a wide range of key therapeutic areas, including globally recognized iconic and key brands, generic, complex generic, and biosimilar products. Branded products include EpiPen, Amitiza, Lipitor and Viagra. Biosimilars portfolio include pegfilgrastim, trastuzumab and adalimumab biosimilars. It has obtained approval for the biosimilar of Avastin and Insulin Aspart in Europe. The company reports in following segments: Developed Markets, Greater China, JANZ & Emerging Markets. The Developed Markets segment comprises operations in N. America and Europe. The Greater China segment operates in China, Taiwan and Hong Kong. The JANZ segment will report for operations in Japan, Australia and New Zealand, while the Emerging Markets segment will include operations in Asia, the Middle East, South and Central America, Africa and E. Europe. This segment also includes the company's anti-retroviral franchise.

Number of Employees: 30,000 |

|

|

| |

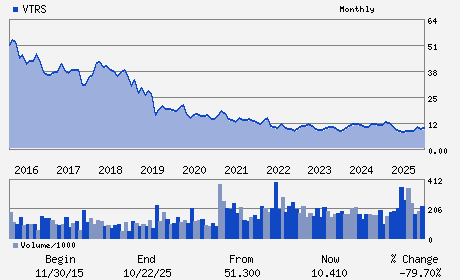

| • Price / Volume Information |

| Yesterday's Closing Price: $14.93 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 11,327,010 shares |

| Shares Outstanding: 1,151.39 (millions) |

| Market Capitalization: $17,190.30 (millions) |

| Beta: 0.78 |

| 52 Week High: $16.47 |

| 52 Week Low: $6.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.06% |

15.05% |

| 12 Week |

36.60% |

36.43% |

| Year To Date |

19.92% |

19.34% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Scott A. Smith - Chief Executive Officer

Melina Higgins - Chairperson

Mark Parrish - Vice Chairman

Theodora Mistras - Chief Financial Officer

Paul Campbell - Chief Accounting Officer and Corporate Controller

|

|

Peer Information

Viatris Inc. (CHCR)

Viatris Inc. (ESRX)

Viatris Inc. (MYDP)

Viatris Inc. (COR)

Viatris Inc. (GBCS)

Viatris Inc. (LAXAF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Medical Services

Sector: Medical

CUSIP: 92556V106

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 1,151.39

Most Recent Split Date: 10.00 (1.50:1)

Beta: 0.78

Market Capitalization: $17,190.30 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.21% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.55 |

Indicated Annual Dividend: $0.48 |

| Current Fiscal Year EPS Consensus Estimate: $2.45 |

Payout Ratio: 0.20 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: 4.33% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |