| Zacks Company Profile for V2X, Inc. (VVX : NYSE) |

|

|

| |

| • Company Description |

| V2X Inc. is a provider of critical mission solutions and support to defense clients. The Company delivers a comprehensive suite of integrated solutions across the operations and logistics, aerospace, training and technology markets to national security, defense, civilian and international clients. V2X Inc., formerly known as Vectrus Inc., is based in MCLEAN, Va.

Number of Employees: 16,200 |

|

|

| |

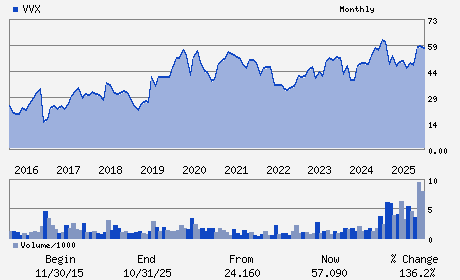

| • Price / Volume Information |

| Yesterday's Closing Price: $70.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 473,542 shares |

| Shares Outstanding: 31.17 (millions) |

| Market Capitalization: $2,212.38 (millions) |

| Beta: 0.12 |

| 52 Week High: $73.79 |

| 52 Week Low: $42.09 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.12% |

8.60% |

| 12 Week |

29.13% |

28.47% |

| Year To Date |

30.10% |

29.42% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1875 CAMPUS COMMONS DRIVE SUITE 305

-

RESTON,VA 20191

USA |

ph: 571-481-2000

fax: 719-591-3599 |

ir@gov2x.com |

http://www.gov2x.com |

|

|

| |

| • General Corporate Information |

Officers

Jeremy C. Wensinger - Chief Executive Officer; President and Director

Mary L. Howell - Chair and Director

Shawn M. Mural - Chief Financial Officer

David E. Farnsworth - Director

Gerard A. Fasano - Director

|

|

Peer Information

V2X, Inc. (EVOL)

V2X, Inc. (RAMP)

V2X, Inc. (LGTY)

V2X, Inc. (ALOT)

V2X, Inc. (CXT)

V2X, Inc. (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 92242T101

SIC: 8744

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 31.17

Most Recent Split Date: (:1)

Beta: 0.12

Market Capitalization: $2,212.38 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.24 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.86 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 20.20% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |