| Zacks Company Profile for Walker & Dunlop, Inc. (WD : NYSE) |

|

|

| |

| • Company Description |

| Walker & Dunlop, LLC is engaged in providing commercial real estate financial services in the United States, with a primary focus on multifamily lending. The Company also offers service loans for life insurance companies, commercial banks and other institutional investors as a loan broker. The Multifamily and FHA Finance groups of Walker & Dunlop are focused on lending to property owners, investors, and developers of multifamily properties across the country. The Capital Markets and Investment Services groups provide a broad range of advisory, financing, investment consulting and related services. Walker & Dunlop's Healthcare Finance group provides debt financing for healthcare properties. The Company's Principle Investments include origination, underwriting, execution and management of commercial real estate opportunities across property types and geographies within the continental United States. Walker & Dunlop, LLC is based in Bethesda, Maryland.

Number of Employees: 1,399 |

|

|

| |

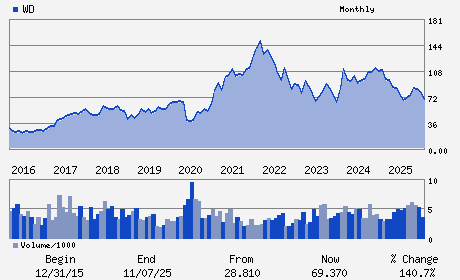

| • Price / Volume Information |

| Yesterday's Closing Price: $50.35 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 383,233 shares |

| Shares Outstanding: 34.06 (millions) |

| Market Capitalization: $1,714.94 (millions) |

| Beta: 1.57 |

| 52 Week High: $90.00 |

| 52 Week Low: $42.12 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-21.95% |

-21.80% |

| 12 Week |

-20.60% |

-20.40% |

| Year To Date |

-16.29% |

-16.58% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

William M. Walker - Chairman and Chief Executive Officer

Gregory A. Florkowski - Executive Vice President and Chief Financial Offi

Ernest Freedman - Director

Jeffery Hayward - Director

Ellen Levy - Director

|

|

Peer Information

Walker & Dunlop, Inc. (DFCLQ)

Walker & Dunlop, Inc. (VEL)

Walker & Dunlop, Inc. (CFC)

Walker & Dunlop, Inc. (T.FTI)

Walker & Dunlop, Inc. (CLNH.)

Walker & Dunlop, Inc. (BFSC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-MTG&REL SVS

Sector: Finance

CUSIP: 93148P102

SIC: 6199

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 34.06

Most Recent Split Date: (:1)

Beta: 1.57

Market Capitalization: $1,714.94 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 5.32% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $2.68 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.77 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.32 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |