| Zacks Company Profile for Western Digital Corporation (WDC : NSDQ) |

|

|

| |

| • Company Description |

| Western Digital Corporation is one of the largest hard disk drive producers in the U.S. The company designs, develops, manufactures and markets a broad range of HDDs used in desktop PCs, servers, network-attached storage devices, video game consoles, digital video recorders and a host of other consumer electronic devices. The acquisition of SanDisk enabled the company to venture into the flash drive storage technology space. Western Digital sells hard drives of 3.5-inch and 2.5-inch form factors with storage capacities ranging from 30 gigabytes (GB) to 6 terabytes (TB). The company's solid-state drives (SSDs) include 2.5-inch, mSATA, MO-297 and CompactFlash form factors, with storage capacities ranging from 128 megabytes (MB) to 400 GB. The company provides WD software applications, such as WD Photos and WD 2GO to the mobile computing market. The company's solutions are compatible with Apple's iOS, Google's Android and Microsoft's Windows Platforms.

Number of Employees: 40,000 |

|

|

| |

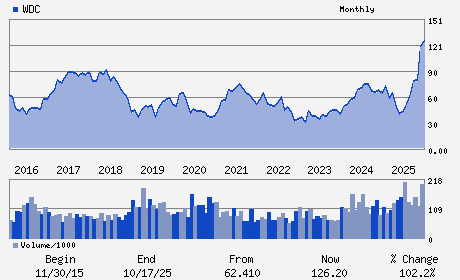

| • Price / Volume Information |

| Yesterday's Closing Price: $279.70 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 10,386,938 shares |

| Shares Outstanding: 339.04 (millions) |

| Market Capitalization: $94,828.91 (millions) |

| Beta: 1.75 |

| 52 Week High: $309.90 |

| 52 Week Low: $28.83 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.78% |

12.76% |

| 12 Week |

65.61% |

65.41% |

| Year To Date |

62.36% |

61.57% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Irving Tan - Chief Executive Officer; Director

Martin I. Cole - Chair of the Board

Kris Sennesael - Executive Vice President and Chief Financial Offic

Kimberly E. Alexy - Director

Tunc Doluca - Director

|

|

Peer Information

Western Digital Corporation (CPCIQ)

Western Digital Corporation (SNDK)

Western Digital Corporation (CBEX)

Western Digital Corporation (DTLK)

Western Digital Corporation (LCRD)

Western Digital Corporation (FLSH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-STORAGE DE

Sector: Computer and Technology

CUSIP: 958102105

SIC: 3572

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 339.04

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.75

Market Capitalization: $94,828.91 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.18% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.23 |

Indicated Annual Dividend: $0.50 |

| Current Fiscal Year EPS Consensus Estimate: $8.48 |

Payout Ratio: 0.08 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.06 |

| Estmated Long-Term EPS Growth Rate: 51.11% |

Last Dividend Paid: 12/04/2025 - $0.12 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |