| Zacks Company Profile for Woodside Energy Group Ltd (WDS : NYSE) |

|

|

| |

| • Company Description |

| Woodside Energy Group Ltd engages in the exploration, evaluation, development, production and marketing of hydrocarbons principally in the Asia Pacific, Africa, the Americas and the Europe. The company produces liquefied natural gas, pipeline gas, crude oil and condensate and natural gas liquids. Woodside Energy Group Ltd, formerly known as Woodside Petroleum Ltd, is based in Perth, Australia.

Number of Employees: |

|

|

| |

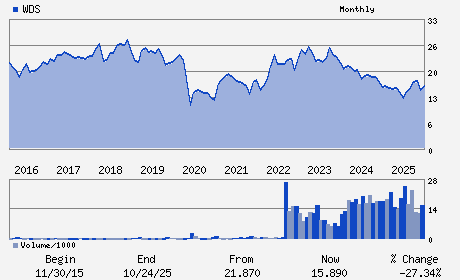

| • Price / Volume Information |

| Yesterday's Closing Price: $20.48 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 864,281 shares |

| Shares Outstanding: 1,901.10 (millions) |

| Market Capitalization: $38,934.53 (millions) |

| Beta: 0.38 |

| 52 Week High: $21.58 |

| 52 Week Low: $11.26 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

16.23% |

17.25% |

| 12 Week |

23.52% |

23.37% |

| Year To Date |

31.37% |

30.73% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Mia Yellagonga 11 Mount Street

-

Perth,C3 6000

AUS |

ph: 61-8-9348-4000

fax: 61-4-1047-1079 |

None |

http://www.woodside.com.au |

|

|

| |

| • General Corporate Information |

Officers

Marguerite O'Neill - Chief Executive Officer

Richard Goyder - Chairman

Larry Archibald - Director

Frank Cooper - Director

Swee Chen Goh - Director

|

|

Peer Information

Woodside Energy Group Ltd (APWR)

Woodside Energy Group Ltd (USFCQ)

Woodside Energy Group Ltd (SGII.)

Woodside Energy Group Ltd (APGI)

Woodside Energy Group Ltd (HYDP)

Woodside Energy Group Ltd (FCEL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Other Alt Energy

Sector: Oils/Energy

CUSIP: 980228308

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 05/25/26

|

|

Share - Related Items

Shares Outstanding: 1,901.10

Most Recent Split Date: (:1)

Beta: 0.38

Market Capitalization: $38,934.53 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.98% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.02 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/25/26 |

|

|

|

| |