| Zacks Company Profile for Advanced Drainage Systems, Inc. (WMS : NYSE) |

|

|

| |

| • Company Description |

| Advanced Drainage Systems, Inc. is a manufacturer of thermoplastic corrugated pipe, providing a comprehensive suite of water management products and drainage solutions for use in the construction and infrastructure marketplace. The company provides single, double, and triple wall corrugated polypropylene and polyethylene pipes; and allied products comprising PVC drainage structures, fittings and filters, and water quality filters and separators. Its products are used across a broad range of end markets and applications, including non-residential, residential, agriculture and infrastructure applications. Advanced Drainage Systems, Inc. is headquartered in Hilliard, Ohio.

Number of Employees: 6,000 |

|

|

| |

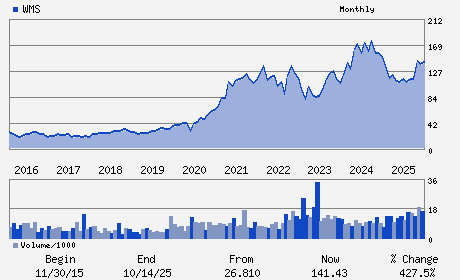

| • Price / Volume Information |

| Yesterday's Closing Price: $171.34 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 759,140 shares |

| Shares Outstanding: 77.90 (millions) |

| Market Capitalization: $13,346.63 (millions) |

| Beta: 1.27 |

| 52 Week High: $179.32 |

| 52 Week Low: $93.92 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.69% |

13.68% |

| 12 Week |

15.06% |

14.91% |

| Year To Date |

18.30% |

17.73% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

D. Scott Barbour - President; Chief Executive Officer and Director

Robert M. Eversole - Chairman and Director

Scott A. Cottrill - Executive Vice President; Chief Financial Officer

Tim A. Makowski - Vice President; Controller and Chief Accounting Of

Anesa T. Chaibi - Director

|

|

Peer Information

Advanced Drainage Systems, Inc. (CSRLY)

Advanced Drainage Systems, Inc. (ARRD)

Advanced Drainage Systems, Inc. (CGMCQ)

Advanced Drainage Systems, Inc. (CMCJY)

Advanced Drainage Systems, Inc. (OMRP)

Advanced Drainage Systems, Inc. (ABLT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG&CONST-MISC

Sector: Construction

CUSIP: 00790R104

SIC: 3086

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/21/26

|

|

Share - Related Items

Shares Outstanding: 77.90

Most Recent Split Date: (:1)

Beta: 1.27

Market Capitalization: $13,346.63 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.42% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.98 |

Indicated Annual Dividend: $0.72 |

| Current Fiscal Year EPS Consensus Estimate: $6.10 |

Payout Ratio: 0.12 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 13.92% |

Last Dividend Paid: 12/01/2025 - $0.18 |

| Next EPS Report Date: 05/21/26 |

|

|

|

| |