| Zacks Company Profile for W&T Offshore, Inc. (WTI : NYSE) |

|

|

| |

| • Company Description |

| W&T Offshore, Inc. is a leading oil and natural gas explorer with operations primarily focused on resources located off the coast of Gulf of Mexico. This has enabled the company to develop significant technical expertise in the major prolific oceanic rift basin. The company sells its crude oil, natural gas liquids (NGLs) and natural gas at the wellhead at current market prices to third party clients. Also, the company transports its output to pooling points where it is sold. The company has stakes in offshore structures, of which are located at the fields where the company is the operator.

Number of Employees: 400 |

|

|

| |

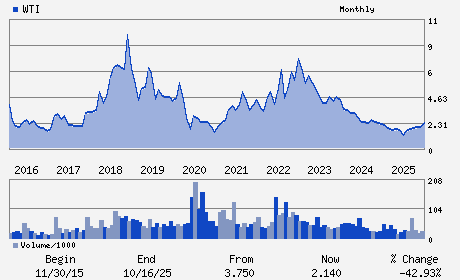

| • Price / Volume Information |

| Yesterday's Closing Price: $3.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,359,747 shares |

| Shares Outstanding: 148.78 (millions) |

| Market Capitalization: $446.33 (millions) |

| Beta: 0.26 |

| 52 Week High: $3.19 |

| 52 Week Low: $1.09 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

45.63% |

47.64% |

| 12 Week |

65.75% |

64.90% |

| Year To Date |

84.05% |

83.08% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Tracy W. Krohn - Chairman; Chief Executive Officerand President

Sameer Parasnis - Executive Vice President and Chief Financial Offic

Bart P. Hartman - Vice President

Virginia Boulet - Director

John D. Buchanan - Director

|

|

Peer Information

W&T Offshore, Inc. (AEGG)

W&T Offshore, Inc. (CHAR)

W&T Offshore, Inc. (CECX.)

W&T Offshore, Inc. (DLOV)

W&T Offshore, Inc. (WACC)

W&T Offshore, Inc. (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 92922P106

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 148.78

Most Recent Split Date: (:1)

Beta: 0.26

Market Capitalization: $446.33 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.33% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.10 |

Indicated Annual Dividend: $0.04 |

| Current Fiscal Year EPS Consensus Estimate: $-0.44 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |