| Zacks Company Profile for Essential Utilities Inc. (WTRG : NYSE) |

|

|

| |

| • Company Description |

| Essential Utilities, Inc., through its subsidiaries, operates regulated utilities that provide water, wastewater and natural gas services in the United States. The company provides utility services to nearly five million people in the U.S. It completed the acquisition of Peoples Gas. It has identified 12 operating segments and 2 reportable segments, namely Regulated Water and Regulated Natural Gas. The Regulated Water segment comprises 8 operating segments for its water and wastewater regulated utility companies, and the Regulated Natural Gas segment includes 1 operating segment representing natural gas utility companies. Also, the company includes 3 of its operating segments in Other. The Other segment represents non-regulated natural gas operations, Aqua Resources and Aqua Infrastructure. Its water supplies are primarily self-supplied and processed at surface water treatment plants as well as numerous well stations in the states in which it conducts business.

Number of Employees: 3,303 |

|

|

| |

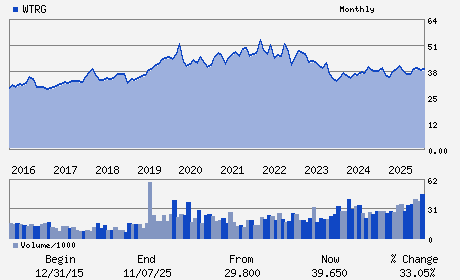

| • Price / Volume Information |

| Yesterday's Closing Price: $40.15 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,482,484 shares |

| Shares Outstanding: 283.12 (millions) |

| Market Capitalization: $11,367.18 (millions) |

| Beta: 0.82 |

| 52 Week High: $42.37 |

| 52 Week Low: $36.32 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.97% |

6.41% |

| 12 Week |

7.18% |

6.63% |

| Year To Date |

4.67% |

4.12% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christopher H. Franklin - Chief Executive Officer; Chairman; President and D

Daniel J. Schuller - Executive Vice President and Chief Financial Offic

Bradley J. Palmer - Bradley J. PalmerVice President and Chief Accounti

Elizabeth B. Amato - Director

Christopher L. Bruner - Director

|

|

Peer Information

Essential Utilities Inc. (VWTR)

Essential Utilities Inc. (WAAS)

Essential Utilities Inc. (CTWS)

Essential Utilities Inc. (CDZI)

Essential Utilities Inc. (PNNW)

Essential Utilities Inc. (AWR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: UTIL-WATER SPLY

Sector: Utilities

CUSIP: 29670G102

SIC: 4941

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 283.12

Most Recent Split Date: 9.00 (1.25:1)

Beta: 0.82

Market Capitalization: $11,367.18 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.41% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.01 |

Indicated Annual Dividend: $1.37 |

| Current Fiscal Year EPS Consensus Estimate: $2.23 |

Payout Ratio: 0.62 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/09/2026 - $0.34 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |