| Zacks Company Profile for Wynn Resorts, Limited (WYNN : NSDQ) |

|

|

| |

| • Company Description |

| Wynn Resorts, Limited together with its subsidiaries, is a leading developer, owner and operator of casino resorts. The company owns and operates casino hotel resort properties Wynn Las Vegas and Encore in Las Vegas, as well as Wynn Macau and the Wynn Palace located in the Special Administrative Region of Macau in the People's Republic of China. The Company holds more Forbes Travel Guide Five Stars than any other independent hotel company in the world. Wynn Resorts is currently constructing Wynn Boston Harbor located in Everett, Massachusetts.

Number of Employees: 28,000 |

|

|

| |

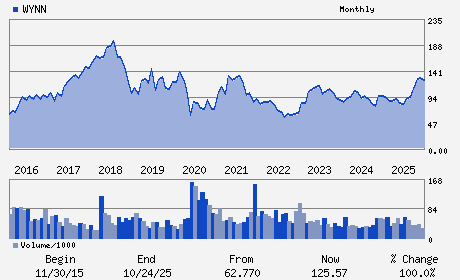

| • Price / Volume Information |

| Yesterday's Closing Price: $103.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,840,761 shares |

| Shares Outstanding: 103.97 (millions) |

| Market Capitalization: $10,755.12 (millions) |

| Beta: 1.01 |

| 52 Week High: $134.72 |

| 52 Week Low: $65.25 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.26% |

-3.95% |

| 12 Week |

-18.63% |

-19.05% |

| Year To Date |

-14.04% |

-14.49% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Craig S. Billings - Chief Executive Officer

Philip G. Satre - Chair of the Board and Director

Julie Cameron-Doe - Chief Financial Officer

Betsy S. Atkins - Director

Richard J. Byrne - Director

|

|

Peer Information

Wynn Resorts, Limited (CHLD.)

Wynn Resorts, Limited (FGRD)

Wynn Resorts, Limited (CGMI.)

Wynn Resorts, Limited (AGAM.)

Wynn Resorts, Limited (ASCA.)

Wynn Resorts, Limited (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 983134107

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 103.97

Most Recent Split Date: (:1)

Beta: 1.01

Market Capitalization: $10,755.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.97% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.18 |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.80 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 1.76% |

Last Dividend Paid: 02/23/2026 - $0.25 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |