| Zacks Company Profile for Exela Technologies, Inc. (XELA : OTC) |

|

|

| |

| • Company Description |

| Exela Technologies, Inc. is engaged in providing information and transaction processing solutions. The Company's segments include Information and Transaction Processing Solutions, Healthcare Solutions and Legal & Loss Prevention Services. ITPS provides industry solutions for banking and financial services, including lending solutions for mortgages, banking solutions for clearing, anti-money laundering, sanctions, cross-border settlement; property and casualty insurance solutions for enrollments, and communications. The HS segment offerings include integrated accounts payable and accounts receivable, and information management for both the healthcare payer and provider markets. The LLPS segment solutions include processing of legal claims for class action and mass action settlement administrations, involving project management support, notification and collection, analysis, and distribution of settlement funds. Exela Technologies Inc., formerly known as Quinpario Acquisition Corp. 2, is based in United States.

Number of Employees: |

|

|

| |

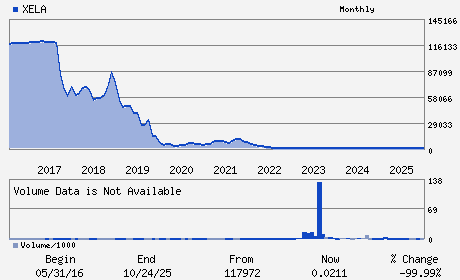

| • Price / Volume Information |

| Yesterday's Closing Price: $0.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,571 shares |

| Shares Outstanding: 6.37 (millions) |

| Market Capitalization: $0.32 (millions) |

| Beta: 3.60 |

| 52 Week High: $0.67 |

| 52 Week Low: $0.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-29.87% |

-28.91% |

| 12 Week |

24.07% |

23.44% |

| Year To Date |

354.55% |

352.16% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Par Chadha - Executive Chairman

Matthew T. Brown - Interim Chief Financial Officer

Martin P. Akins - Director

Marc A. Beilinson - Director

Sharon Chadha - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 30162V805

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 6.37

Most Recent Split Date: 5.00 (0.01:1)

Beta: 3.60

Market Capitalization: $0.32 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |