| Zacks Company Profile for Xylem Inc. (XYL : NYSE) |

|

|

| |

| • Company Description |

| Xylem Inc. is one of the leading providers of water solutions world wide and involved in the full water-process cycle, including collection, distribution and returning of water to the environment. It reports business operations under three segments: Water Infrastructure, Measurement & Control Solutions and Applied Water. Water Infrastructure unit offers product range mainly used for transportation, treatment and testing of water. This unit includes two applications: Transport and Treatment and markets under brands like Flygt, Godwin, Leopold, WEDECO and Sanitaire. Applied Water segment offers various products that deal with the use of water. Brands like Goulds Water Technology, Lowara, Bell & Gossett, A-C Fire Pump, Standard, Jabsco, and Flojet form parts of this segment. Measurement & Control Solutions segment includes consolidated results of Xylem's Analytics, Sensus and Visenti businesses. These products have a wide range of applications that include Water, Energy, Test and Software as a Service/Other.

Number of Employees: 22,000 |

|

|

| |

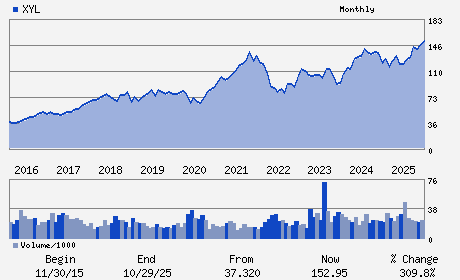

| • Price / Volume Information |

| Yesterday's Closing Price: $129.56 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,132,266 shares |

| Shares Outstanding: 243.14 (millions) |

| Market Capitalization: $31,501.40 (millions) |

| Beta: 1.17 |

| 52 Week High: $154.27 |

| 52 Week Low: $100.47 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.03% |

-5.21% |

| 12 Week |

-6.80% |

-6.91% |

| Year To Date |

-4.86% |

-5.32% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Matthew F. Pine - President and Chief Executive Officer

Robert F. Friel - Board Chair

William K. Grogan - Executive Vice President; Chief Financial Officer

Geri-Michelle McShane - Senior Vice President; Chief Accounting Officer

Earl R. Ellis - Director

|

|

Peer Information

Xylem Inc. (TBLZ)

Xylem Inc. (ESGL)

Xylem Inc. (RDUS)

Xylem Inc. (PNR)

Xylem Inc. (HTO)

Xylem Inc. (TGGI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Waste Removal Svcs

Sector: Business Services

CUSIP: 98419M100

SIC: 3561

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 243.14

Most Recent Split Date: (:1)

Beta: 1.17

Market Capitalization: $31,501.40 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.33% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.09 |

Indicated Annual Dividend: $1.72 |

| Current Fiscal Year EPS Consensus Estimate: $5.48 |

Payout Ratio: 0.31 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.08 |

| Estmated Long-Term EPS Growth Rate: 12.74% |

Last Dividend Paid: 02/24/2026 - $0.43 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |