| Zacks Company Profile for Yum! Brands, Inc. (YUM : NYSE) |

|

|

| |

| • Company Description |

| YUM Brands Inc. had spun off from PepsiCo. YUM Brands is the global leader in multi-branding and offers consumers more choice and convenience at one outlet. The company presently reports through four segments - KFC, Pizza Hut, Taco Bell and Habit Burger Grill. Notably, Yum Brands now owns, operates and franchises restaurants in more than 150 countries and territories. The company's units were operated by independent franchisees or licensees under the terms of franchise or license agreements. The Company's KFC, Pizza Hut and Taco Bell brands are global leaders of the chicken, pizza and Mexican-style food categories, respectively. The company acquired Habit Burger Grill - a fast-casual restaurant concept specializing in made-to-order chargrilled burgers, sandwiches and more.The company exercises store-level franchise and master franchise programs to grow its businesses.

Number of Employees: 49,000 |

|

|

| |

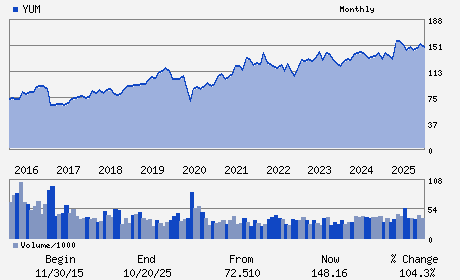

| • Price / Volume Information |

| Yesterday's Closing Price: $162.92 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,955,804 shares |

| Shares Outstanding: 276.43 (millions) |

| Market Capitalization: $45,036.00 (millions) |

| Beta: 0.64 |

| 52 Week High: $169.39 |

| 52 Week Low: $137.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.32% |

5.76% |

| 12 Week |

14.31% |

13.72% |

| Year To Date |

7.69% |

7.13% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1441 Gardiner Lane

-

Louisville,KY 40213

USA |

ph: 502-874-8300

fax: 502-874-8323 |

yum.investor@yum.com |

http://www.yum.com |

|

|

| |

| • General Corporate Information |

Officers

Chris Turner - Chief Executive Officer

Ranjith Roy - Chief Financial Officer

David Russell - Senior Vice President; Finance and Corporate Contr

Paget Alves - Director

Brett Biggs - Director

|

|

Peer Information

Yum! Brands, Inc. (BH)

Yum! Brands, Inc. (BUCA)

Yum! Brands, Inc. (BUNZQ)

Yum! Brands, Inc. (FRRG)

Yum! Brands, Inc. (CHEF.)

Yum! Brands, Inc. (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: 988498101

SIC: 5812

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 276.43

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.64

Market Capitalization: $45,036.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.84% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.37 |

Indicated Annual Dividend: $3.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.63 |

Payout Ratio: 0.47 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 10.71% |

Last Dividend Paid: 02/20/2026 - $1.46 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |