| Zacks Company Profile for Zimmer Biomet Holdings, Inc. (ZBH : NYSE) |

|

|

| |

| • Company Description |

| Zimmer Biomet is a leading musculoskeletal healthcare company that designs, manufactures and markets orthopedic reconstructive products; sports medicine, biologics, extremities and trauma products; spine, bone healing, craniomaxillofacial and thoracic products; dental implants; and related surgical products.

Number of Employees: 17,000 |

|

|

| |

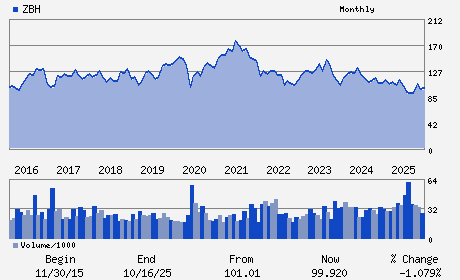

| • Price / Volume Information |

| Yesterday's Closing Price: $99.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,309,827 shares |

| Shares Outstanding: 195.65 (millions) |

| Market Capitalization: $19,465.42 (millions) |

| Beta: 0.58 |

| 52 Week High: $114.44 |

| 52 Week Low: $84.59 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.39% |

16.98% |

| 12 Week |

7.27% |

6.72% |

| Year To Date |

10.64% |

10.06% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ivan Tornos - Chief Executive Officer;President and Director

Suketu Upadhyay - Chief Financial Officer and Executive Vice Preside

Paul Stellato - Vice President; Controller and Chief Accounting Of

Betsy Bernard - Director

Michael Farrell - Director

|

|

Peer Information

Zimmer Biomet Holdings, Inc. (BJCT)

Zimmer Biomet Holdings, Inc. (CADMQ)

Zimmer Biomet Holdings, Inc. (APNO)

Zimmer Biomet Holdings, Inc. (UPDC)

Zimmer Biomet Holdings, Inc. (IMTIQ)

Zimmer Biomet Holdings, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 98956P102

SIC: 3842

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 195.65

Most Recent Split Date: (:1)

Beta: 0.58

Market Capitalization: $19,465.42 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.96% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.86 |

Indicated Annual Dividend: $0.96 |

| Current Fiscal Year EPS Consensus Estimate: $8.39 |

Payout Ratio: 0.12 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.01 |

| Estmated Long-Term EPS Growth Rate: 5.83% |

Last Dividend Paid: 12/30/2025 - $0.24 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |