| Zacks Company Profile for Ziff Davis, Inc. (ZD : NSDQ) |

|

|

| |

| • Company Description |

| Ziff Davis Inc. is a vertically focused digital media and internet company whose portfolio includes brands in technology, entertainment, shopping, health, cybersecurity and martech. Ziff Davis Inc., formerly known as J2 Global Inc., is based in NEW YORK.

Number of Employees: 3,900 |

|

|

| |

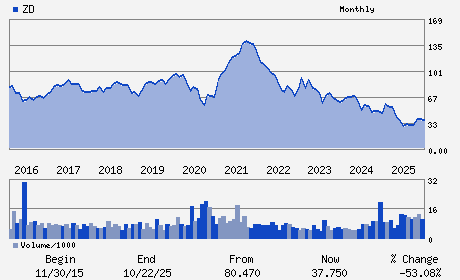

| • Price / Volume Information |

| Yesterday's Closing Price: $27.08 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 870,462 shares |

| Shares Outstanding: 37.65 (millions) |

| Market Capitalization: $1,019.68 (millions) |

| Beta: 1.50 |

| 52 Week High: $43.54 |

| 52 Week Low: $22.45 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-29.15% |

-28.53% |

| 12 Week |

-23.11% |

-23.21% |

| Year To Date |

-22.96% |

-23.33% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Vivek Shah - Chief Executive Officer and Director

Bret Richter - Chief Financial Officer

Lori Tansley - Chief Accounting Officer

Sarah Fay - Director

Jana Barsten - Director

|

|

Peer Information

Ziff Davis, Inc. (ADP)

Ziff Davis, Inc. (CWLD)

Ziff Davis, Inc. (CYBA.)

Ziff Davis, Inc. (ZVLO)

Ziff Davis, Inc. (AZPN)

Ziff Davis, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 48123V102

SIC: 4822

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 37.65

Most Recent Split Date: 5.00 (2.00:1)

Beta: 1.50

Market Capitalization: $1,019.68 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.42 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |